Inflation and forecasting meat prices

Dr. David Boussios, Economist DecisionNext; Former Agricultural Economist, Office of Chief Economist USDA

Abstract

Macroeconomic and financial instability continues to shift markets. Additionally, higher feed prices and strong consumer demand have kept wholesale meat prices historically high through 2022. With persistently high inflation and instability in markets, a natural question becomes, to what extent can inflation measures and macroeconomic indicators be used to forecast meat prices. Analyzing the results of multiple machine learning forecast models, it is clear that the inclusion of macroeconomic variables cause models to overfit to historical observations, leading to larger absolute forecast errors for both beef and, to a lesser extent, pork markets. The results suggest that the predictability of wholesale meat prices continues to be driven by market-specific fundamentals as opposed to broader macroeconomic trends.

Inflation and forecasting meat prices

Prices of agricultural commodities have observed dramatic volatility since the outbreak of the COVID-19 pandemic. Exceptional shocks to domestic and global markets and unparalleled policy responses have turned markets ranging from financial products to boxed beef on their heads. Given the high level and persistence of inflation in the United States (8.3% year-over-year in August 2022), this report examines the macroeconomic situation from theoretical and empirical perspectives, shedding light on future meat prices.

Inflation refers to the rate in which prices are increasing. As prices continue to rise and experience heightened volatility and uncertainty, it is necessary to decompose the macroeconomic indicators to better track and predict price shifts. To that end, we examine several inflation measures from the Bureau of Labor Statistics. The individual components of the macroeconomy can reveal the underlying uncertainty in markets, and allow forecasters to predict prices with a greater degree of confidence. And yet, while inflation continues to upend markets, the added value from using macroeconomic indicators in forecasting cutout meat prices has shown to be mixed. Official inflation indicators are aggregated and delayed from other market signals, rendering their value for forecasting wholesale meat prices problematic.

We expand our analysis by examining newer, higher frequency indicators of macroeconomic and inflation expectations for use in predicting wholesale meat prices. When added to simplistic machine learning (ML) models, the macroeconomic variables frequently overfit the forecasts, leading to less accurate predictions. Our analysis shows that the choice of model is of great importance when using inflation to predict prices, as overfit forecasts adapt poorly to new shocks. Our model finds that the 5-year Treasury breakeven improved the predictability of wholesale pork prices, but only marginally so. At the same time, the beef cutout price forecast was worse off with the inclusion of the Treasury inflation-breakevens. These results suggest that, over a six-month period, wholesale meat prices continue to be shaped by market-specific fundamentals instead of broader macroeconomic themes.

- Assessing the macroeconomic environment through an inflation lens

Inflation is principally related to changes in the supply and demand of a currency. This is notably different from the frequently intertwined “price increase.” The difference between inflations is that the price of a good could change, for example, corn’s price due to drought, but that price change could be unrelated to factors in all other markets. The price increase could actually reduce the price of other goods, as consumers must spend more fixed income on the one good. Inflation is when the price of all goods or services increases, thus relating to a monetary topic instead of market-specific supply or demand shifts.

While conceptually intuitive, its complexity is underlined by a lack of consensus in academic and public discourse around its causes. Rather than attempt to explain its full complexity and causes, we highlight critical contributors to the change in price levels across the economy over the past three years. They are: a) expansionary fiscal and monetary policy responses, b) supply chain shocks and a shift in goods demand, and c) labor market shocks. Each of these contributors alone generate upward pressure on price levels; however, the combination of all three amplifies the impact.

Expansionary Policy

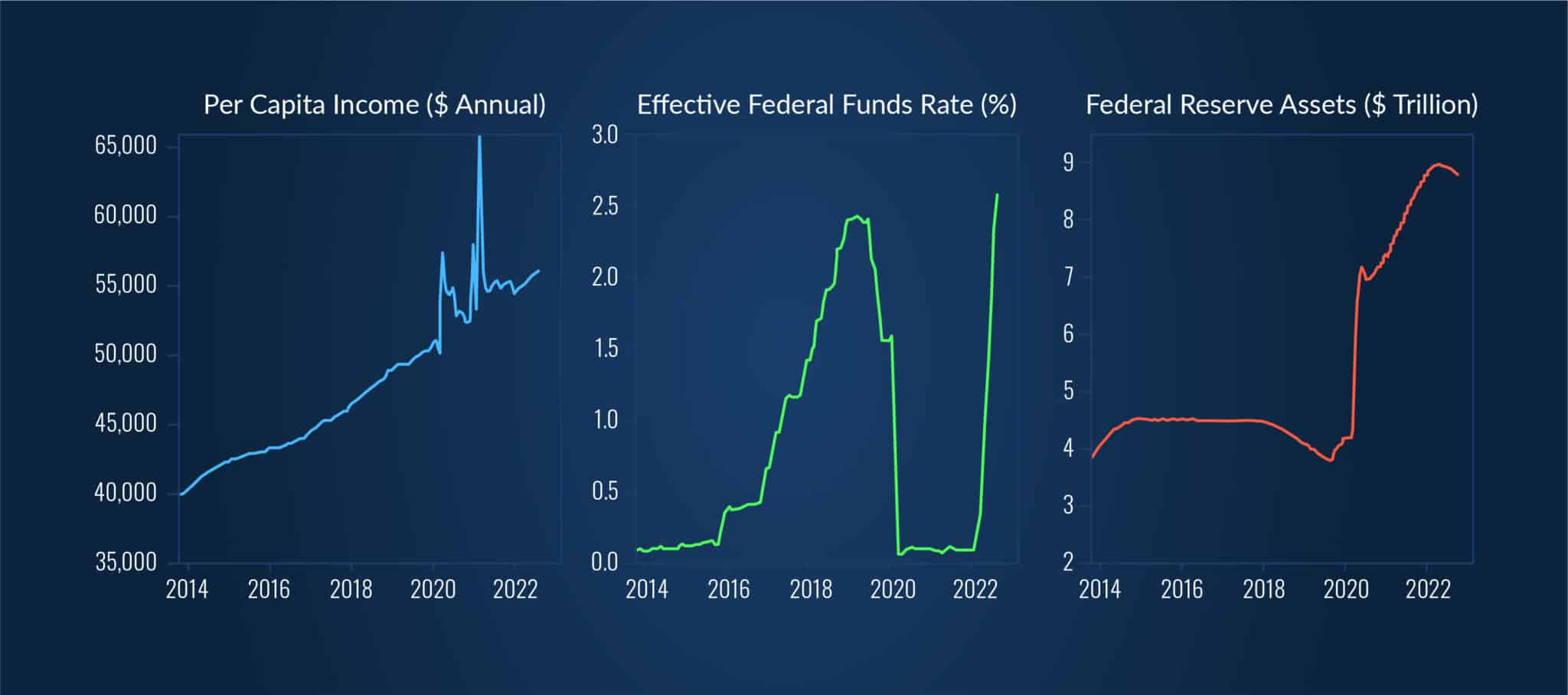

Governments and central banks reacted to the COVID-19-induced global economic crisis with extraordinary expansionary fiscal and monetary responses. After being criticized for a delayed and insufficient reaction to the 2008 Global Financial Crisis (GFC), fiscal policymakers were keen to provide economic support through new measures. U.S. policymakers provided an estimated $5.2 trillion in response to COVID-19 in everything from cash payments to individuals and households, student loan debt payment deferments, forgivable business loans, expanded unemployment benefits, and more. These payments’ net effect resulted in increased personal incomes (figure 3). The fiscal expansion was not unique to the United States, as Australia, Japan, Germany, New Zealand, Canada, Austria, and the United Kingdom provided fiscal packages that exceeded 6% of annual gross domestic product (GDP) in response to the global pandemic.

Almost simultaneously, central banks across the world eased monetary conditions by lowering key interest rates, expanded asset purchases, and reduced bank reserve holdings. These expansionary fiscal and monetary policies were a concerted effort to head off the sharpest increase in unemployment and decline in economic activity on record.

In March 2022, with the economy growing and employment rates near pre-crisis levels, the Federal Reserve began tightening monetary policy to head off high inflation. The central bank initially responded by raising target overnight interest rates and more recently, selling off financial securities. Interest rates across the maturity spectrum have risen in response to the Federal Reserve’s policy shift. Interest rates on 30-year fixed mortgages have moved from a bottom of 2.65% to 6.7%, the highest rate since 2006. The contractionary effect of the rate increases is evidenced by new monthly mortgages being 60% higher in response to the rate change. The increased costs of home ownership put downward pressure on home values, material inputs, construction, home repair, and financial institutions. Home values have begun to show evidence of price declines. Shelter prices are notably the largest weight in the consumer price index (CPI).

While the expansionary fiscal policy has subsided after the recovery of the U.S. economy, some government policies remain expansionary. The Biden administration’s student-loan debt forgiveness Executive Action (EA) is an expansionary policy estimated to cost $400 billion. Additionally, seventeen individual states are providing some form of cash payment or tax rebate in response to inflation. Any form of expansionary fiscal policy is inherently inflationary. The state and EA policies pale in size to the earlier COVID-19-related costs, but are all anticipated to increase inflation.

Supply Chain and Demand for Goods Shocks

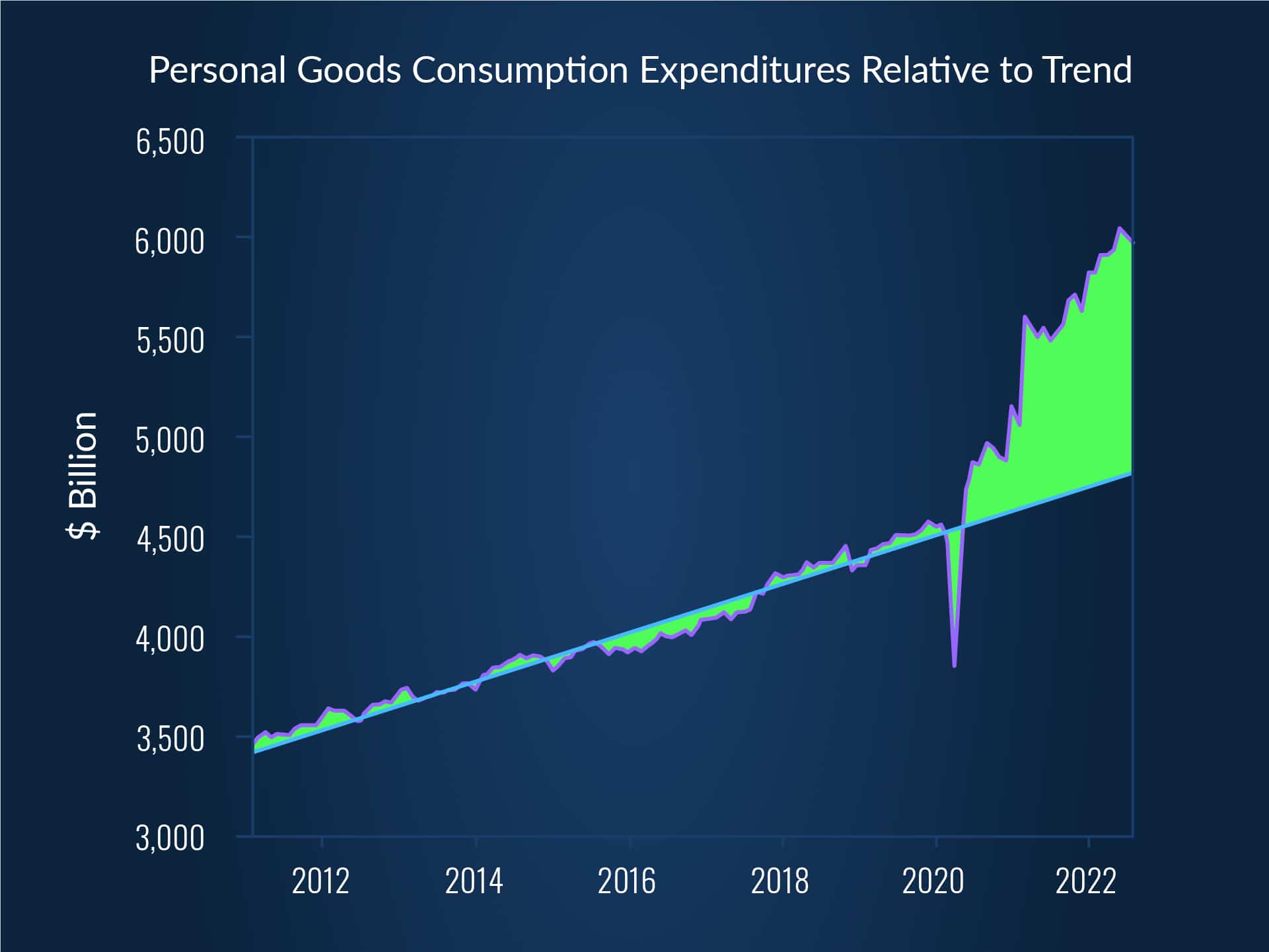

While inflation is a monetary phenomenon, it is not immune to supply and demand shocks in international markets. Consider the impact of COVID-19 on the demand for goods and international travel. Consumers’ standard spending patterns were upended with COVID-19-related lockdowns, shifting preferences of activities away from those that might transmit the virus. Goods consumption dramatically increased, putting pressure on supply chains and international shipping. Figure 4 highlights the magnitude of the shift in goods demand by referencing the total goods expenditures to post-GFC trend level rates.

The resultant impact of goods demand passed through into other markets, such as increased shipping costs worldwide. The world shipping container rate index moved from around $2,000 per 40-foot container to over $10,000 in 2021. Magnifying the effects of higher goods demand was the “covid-zero” policy in China, which created further bottlenecks across international supply chains.

The COVID-19 pandemic continues to impact international travel and the cross-border flow of money. The combined imports and exports of travel for the United States reached $28 billion a month high during 2019 but fell below $5 billion a month during Q3 of 2020. International travel is the largest service category for both imports and exports. Travel service imports remain 18% below 2019 highs (as of July 2022 data). International travel tends to stem from business and higher-income households. With less desire to travel abroad, that money will likely be increasingly spent on goods. They were impacting not only markets but the flow of currencies across borders.

The shift of consumption away from domestic services, such as entertainment, toward goods imported from places such as China significantly impacts the demand for the U.S. currency and financial flows. Other market shocks, such as the Russian invasion of Ukraine or the energy commodity price shock, dramatically impact the price of goods and services. Now a net energy exporter, the U.S. faces a different shock than importers, such as Japan or the EU. Domestically, the energy price spike serves as a transfer of income to energy producers. Internationally, higher energy prices expand the value of U.S. exports and grow the country’s income. However, higher energy prices increase production costs globally and strengthen the U.S. dollar, causing a reduction in the demand for non-energy U.S. exports.

Moving forward, supply chain issues are expected to continue moderating. Container shipping rates have fallen by over 50% since the start of 2022. Large retailers are now dealing with a glut of inventory. International travel is also expected to continue to increase toward prior levels. Declines in goods and inventory demand, a strong US dollar, and further consumption moving toward international travel are likely to dampen price levels in the future.

Shift in labor supply and income distribution

The COVID-19 pandemic created the most significant shock to labor markets on record. Aside from the effect of placing 23.1 million on unemployment in under a month, it changed the labor supply in a variety of markets. While the employment rate of 25–54-year-olds has meaningfully recovered to pre-COVID-19 levels, 600,000 fewer 55+ year-olds are employed. Work environments most susceptible to the spread of COVID-19 observed some of the largest wage increases. Wages in the leisure and hospitality industry are up 20% over the last 32 months. Lower unemployment rates and customers returning to eating out helped workers negotiate higher salaries.

The expansion of wages, coupled with sizable fiscal policy support, gave the employed lower-wage workers a larger share of income. Lower-wage workers spend a greater share of their income on staples, such as food and housing. Increased bargaining power and higher shares of income toward lower-wage individuals is expectedly inflationary, as more income is spent across the economy instead of in savings. Categories such as meat, or higher-quality meat cuts, are likely to increase demand as lower-income wages rise.

With employment rates encroaching pre-COVID-19 highs, much of the distributional income changes have likely occurred. The remaining question is whether lower-wage individuals will hold the relatively higher rate of wage increases or be passed up the wage spectrum. The average hourly wages in the information industry, the highest hourly earnings sector reported by the Bureau of Labor Statistics, have increased by 7.2% since September 2021. In the financial activities industry, the second highest sector by hourly rate, wages are 4.8% higher relative to a year ago. How wages change across the income spectrum remains an essential question to understanding inflation dynamics looking forward. A tight labor market could cause higher wages and bring more workers back into the labor market, raising wages across all wage levels. The employment rate has recovered faster than expected as it is approaching 2019. However, the labor force participation rate remains well below 1990s peaks.

Empirical Assessment

Expansionary fiscal and monetary policy, negative supply chain shocks, and changes in the distributional share of income toward lower-wage jobs are all inflationary. However, the weight of each factor on U.S. inflation remains an open question. Monitoring and evaluating these factors, particularly in a shorter-horizon exercise like forecasting, can bear fruit in planning but is also fraught with challenges. Here we review traditional public indicators for monitoring macroeconomic conditions and inflation, as well as the predictive accuracy from the use of higher frequency indicators.

Traditional inflation indicators

The traditional effort to monitor consumer price inflation in the U.S. is through the Bureau of Labor Statistics (BLS) consumer price index (CPI) and the Bureau of Economic Analysis (BEA) personal consumption expenditures chain-type index (PCE). Measured at the monthly frequency, the CPI and PCE indices, both track the changes in prices of goods and services across the U.S.. Each index is intended to follow a different weighted basket of goods and services that is representative of the U.S. population, thus measures slightly different price changes in the economy.

The producer price index (PPI) produced by the BLS is not a measure of inflation but rather a potential leading indicator of inflation. The monthly indicator can provide suggestive evidence to supply chain shocks and industry price trends. It however, is not useful for tracking inflation due to the necessary aggregation of goods and services across continually evolving and complex supply chains.

In terms of forecasting in real-time, the use of consumer price indices to forecast product prices is challenged by aggregation and delays in reporting. For example, take the consumer price of uncooked beef steaks in the CPI, a category that accounts for 0.2% of the CPI index. Although relatively small, uncooked beef steaks make up a sizable component in the broader food basket. Food is 13.6% of the CPI index. Additionally, the CPI report is released about two weeks after the conclusion of a given month.

Because the CPI is the last step along the supply chain, the index price includes all of the markups and pass-throughs of a product along the supply chain. The combination of markups and aggregation of products within a goods category create noise and reduce the quality for its use as a predictor. Figure 5 compares the consumer price of beef steaks to the weekly wholesale price of beef. The CPI is notably smoother and delayed from the wholesale prices.

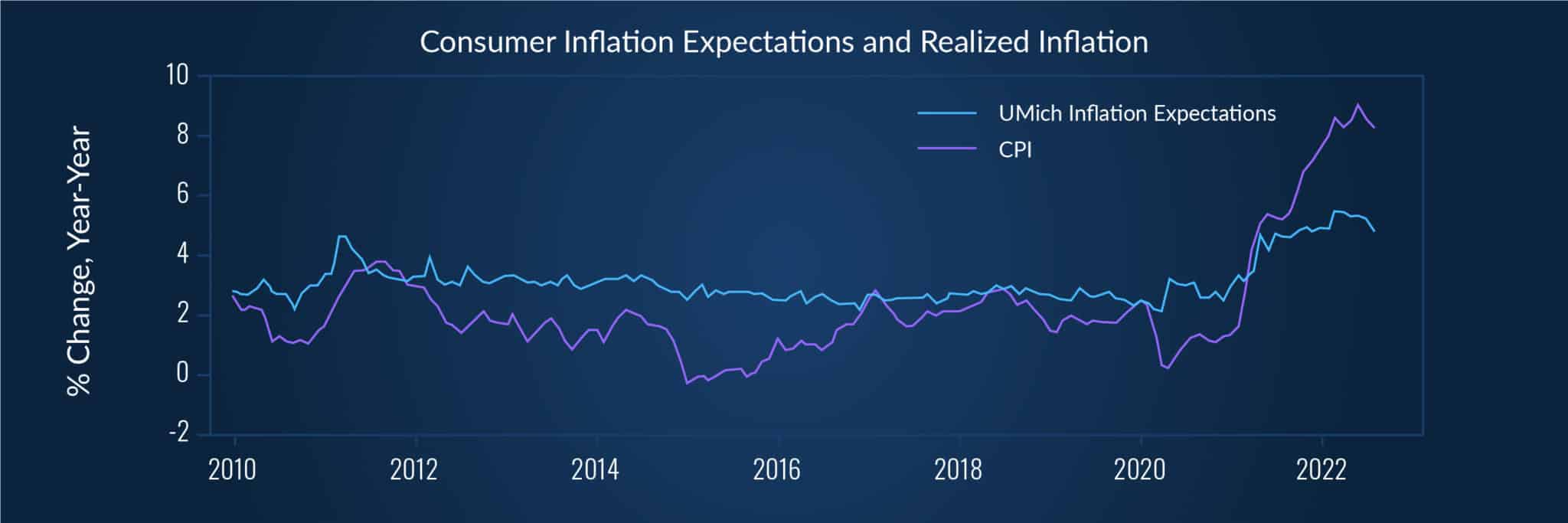

Another standard indicator to monitor and predict inflation is the inflation expectation response within the University of Michigan’s consumer sentiment survey. This monthly survey, however, is more likely a response to inflation levels than predictive, as can be evidenced by figure 6. Survey levels tend to respond to higher inflation instead of predicting future levels, despite the survey language.

Higher frequency, lower latency indicators

Given the latency and frequency issue with monthly indicators, additional indicators have been proposed that may correlate with the inflation situation and may be helpful for prediction. U.S retail gasoline prices, the 5-year breakeven inflation rate, and the Atlanta Federal Reserve’s GDP Nowcast are examined here.

Retail gasoline prices are frequently touted as a leading indicator of macroeconomic conditions due to the prevalence of fuel in everything from manufacturing to commuting. It also correlates with other commodity prices, which have been suggested to track economic business cycles. However, one of the downsides of its use in forecasting is that it is its own commodity, subject to market-specific supply and demand shocks.

The 5-year breakeven inflation rate is the difference between the 5-year constant maturity Treasury securities and the 5-year constant maturity Treasury Inflation-Protected Securities (TIPS). This indicator is a market-based inflation expectation barometer for the next five years. Conceptually, a trader could risk-free arbitrage the rate difference if they could perfectly predict inflation rates. The variable has faced some criticism as an indicator of inflation expectations, as the TIPS notes are suggested to charge varying illiquidity and risk premiums.

The Atlanta Federal Reserve created a “real-time” indicator for GDP forecasts by aggregating multiple economic indices reported at varying frequencies into a single index. The index has shown some success in predicting changes in GDP levels but it remains unknown how it correlates with other variables or its predictability for other indicators.

Figure 7 below, presents the prices for pork and beef cutouts and the three indicators listed earlier.

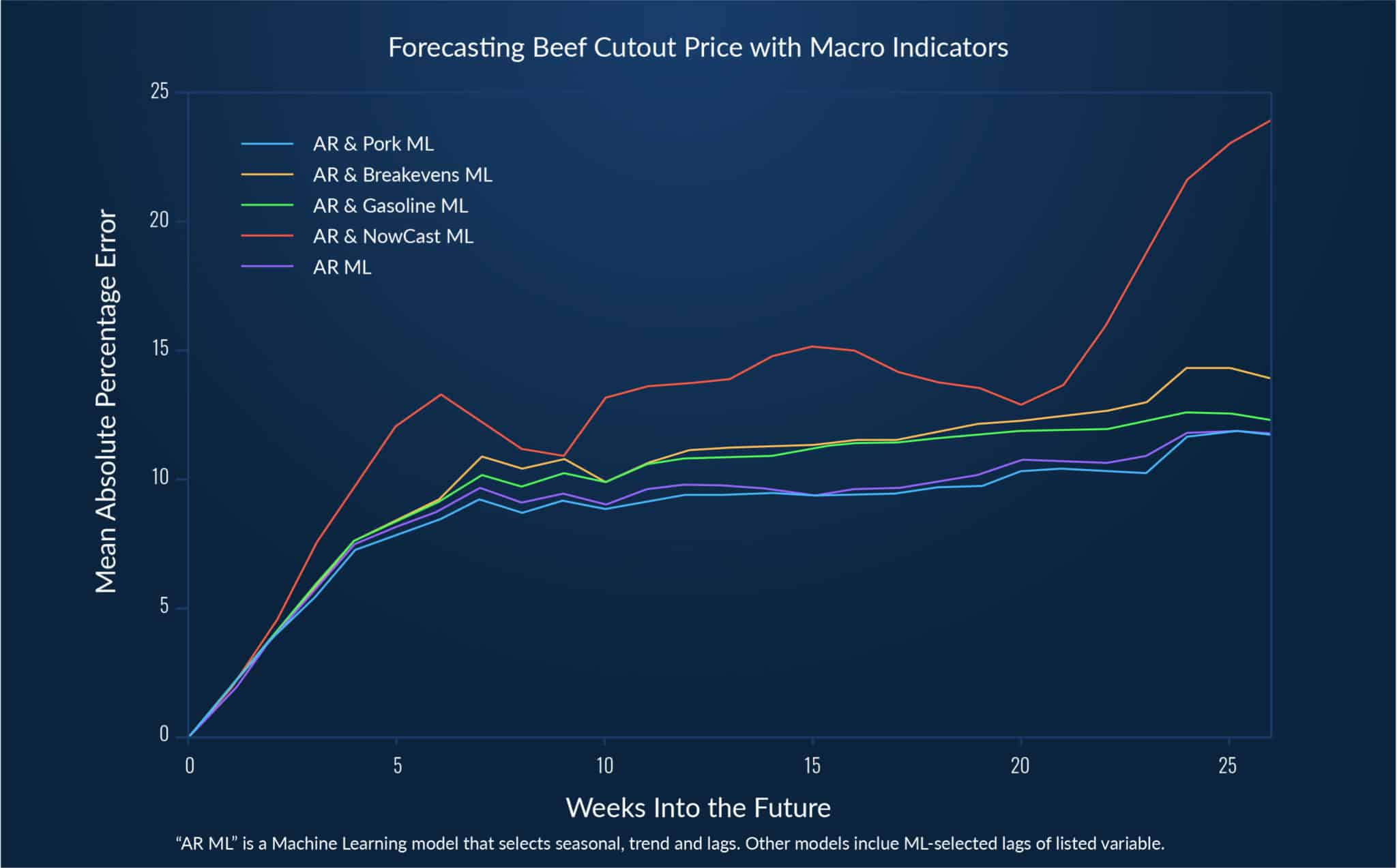

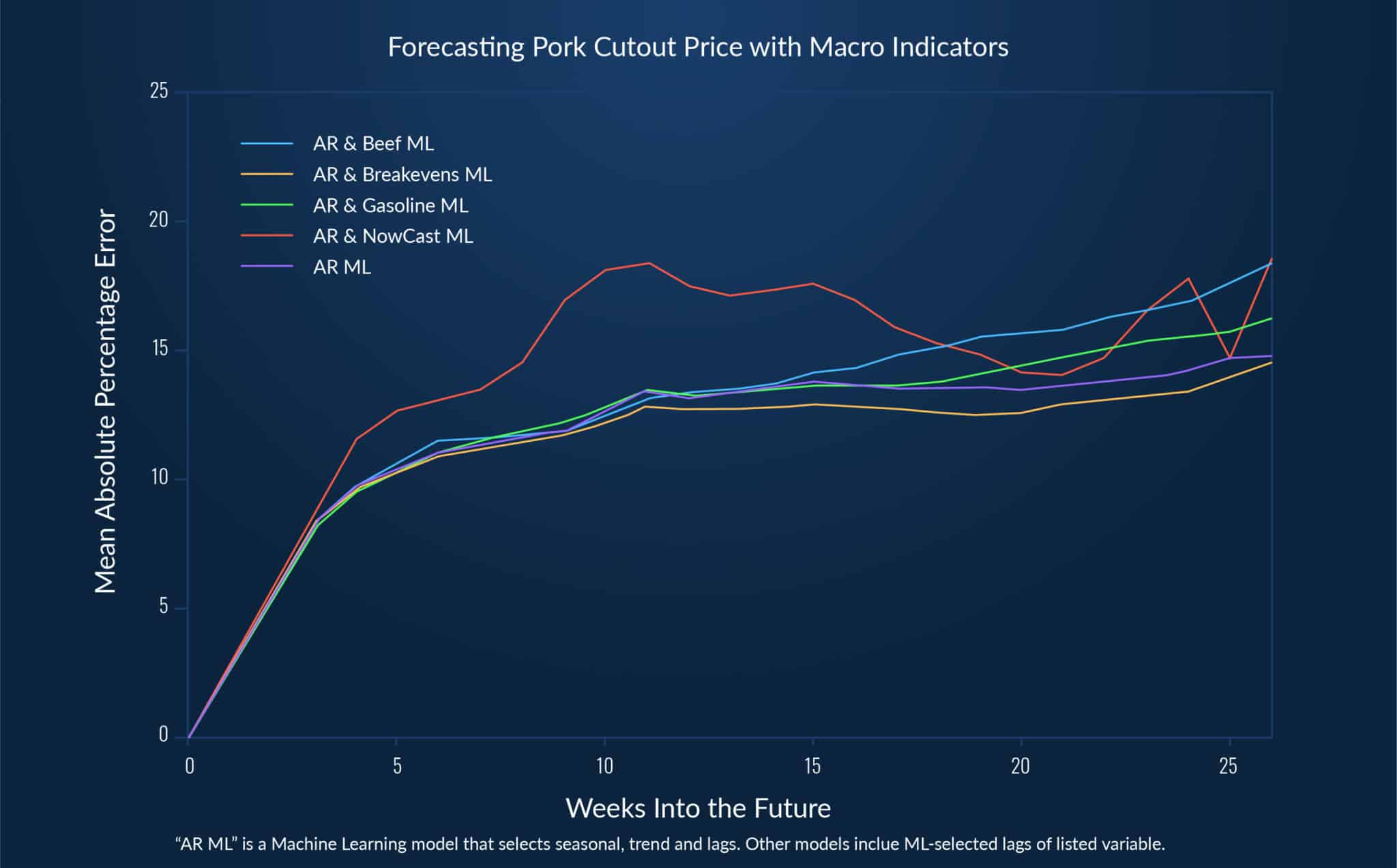

To examine the predictive power of the three macroeconomic indicators for forecasting meat prices (pork and beef cutout values, we estimate machine learning forecast models with and with-out the inclusion of the variables. The standalone ML models utilize solely historical values of the meat cutout prices and seasonality terms for prediction. The automated autoregressive (AR) models serve as a benchmark for forecast performance. Comparing the ML model with the inclusion of the macroeconomic indicators highlights the predictive value with the inclusion of broader macroeconomic themes. For additional inspection, we also test the cross-predictability of meat cutout prices in each of the forecasts.

Including each of the three macroeconomic indicators in our model caused the beef cutout forecast error to increase relative to the ML model with just its own price. The NowCast GDP indicator showed the largest example of forecast overfitting, as forecast errors dramatically increased with its inclusion. The extreme shock to GDP that coincided with the beef cutout increase provided a cautionary example of overfitting, particularly during extreme events. The inclusion of pork cutout prices marginally improved forecast accuracy for beef cutouts relative to the simplified autoregressive ML model.

Similar to the beef cutout forecasts, most of the macroeconomic indicators reduced the forecast accuracy of the pork cutout price forecast. The breakeven inflation indicator, however, did improve the forecast accuracy for pork cutouts across many forecast horizon lengths. The increased accuracy with its inclusion suggests broader price expectations could be related to the demand for pork products. These results suggest further investigation is warranted with its inclusion in more advanced ML models.

Review

With inflation at levels not observed since the 1980s, the topic remains at the forefront to understanding market conditions. Expansionary fiscal and monetary policy, supply chain and goods demand shocks, and the labor market have all worked to increase the price levels of goods and services across the United States. While expansionary policy has subsided with the action of the Federal Reserve, fiscal policy remains moderately expansionary. Supply chain issues, which were prevalent over the past three years, appear to be subsiding. The inflationary impacts from higher wages to lower-wage individuals and a tight labor market are expected to wane over time. Combined, these factors suggest that inflation levels subside, though to what level remains an open question, particularly concerning the Federal Reserve’s 2% average inflation target.

While qualitatively, there is much to uncover in the current inflation climate, translating that into an improved forecast is challenging. The results suggest that the inclusion of higher frequency macroeconomic indicators reduces forecast accuracy. Gasoline prices and real-time GDP indicators appear to overfit, causing larger forecast errors. The 5-year breakeven inflation rate holds promise for improving pork cutout price forecasts, but not for beef cutouts. In tests with more sophisticated models, which include market-specific variables, the beneficial impacts from the inclusion of Treasury breakevens are further diminished.

Improve your Market Forecasting and Analysis

Complete the quick contact form and we’ll be in touch.