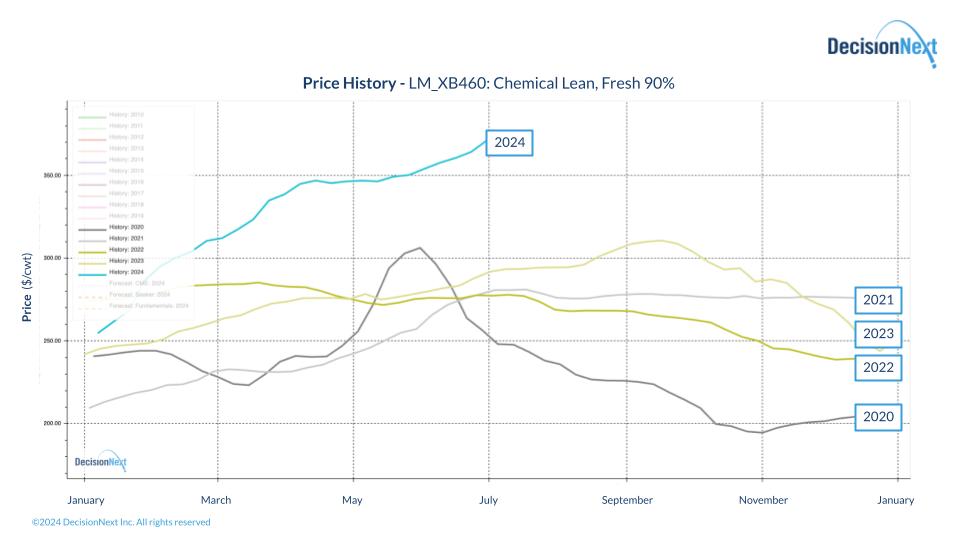

The U.S. is currently facing a shortage of lean trim. This limited supply is driving prices up, and as of July 1, 2024, fresh 90% lean trim is trading at record highs at over 370/cwt (Fig. 1).

Figure 1 – Fresh 90% Beef Trim, price history 2020 – 2024

Two main factors are driving the price surge in 90% trim:

- Cow harvest is lower than the record number we harvested last year.

- Easing drought means that ranchers are starting to look at rebuilding the herd

However, this view only considers the U.S. market. The fact of the matter is if you ignore global markets, you’re doing your company a disservice. You might make your company overpay for lean ground beef.

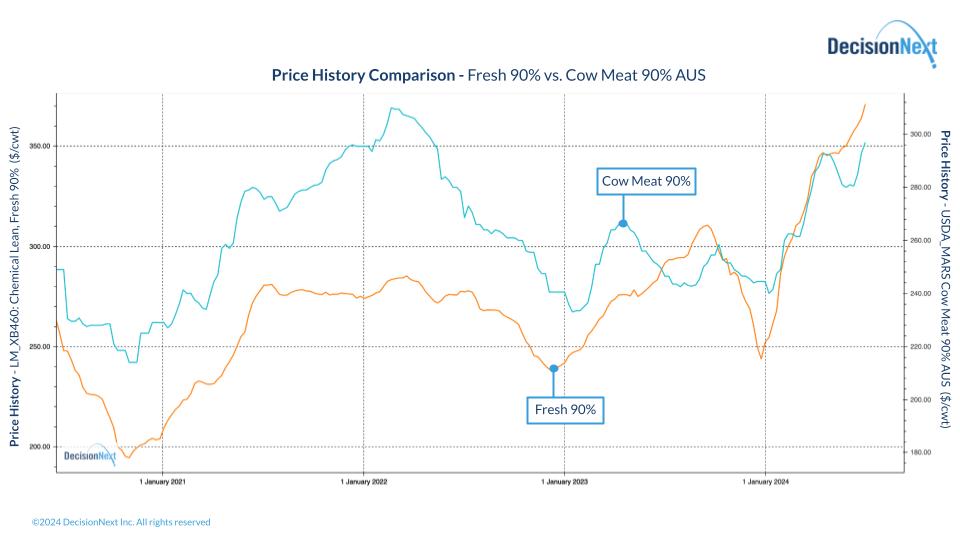

While U.S. 90% beef trim is over 370/cwt, 90% Australian imports are under 300/cwt as of 7/1/24 (Fig. 2). One reason for the price difference is that Australian imports are frozen, while U.S. supplies are fresh.

Figure 2 – Price history comparison between fresh 90% and cow meat 90% AUS

Also note that the DecisionNext Machine Learning forecast model suggests that Australian 90% imports will level off and will stay below 300/cwt for the rest of the year. Contrast that with the forecast for domestic 90% trim, which we are forecasting will not again fall below 300/cwt in 2024 (Fig. 3).

The rules of the game have changed. In order to avoid the million-dollar mistake, you can no longer count on domestic lean points as a sole indicator. Otherwise you’re increasing exposure and risk for your company.