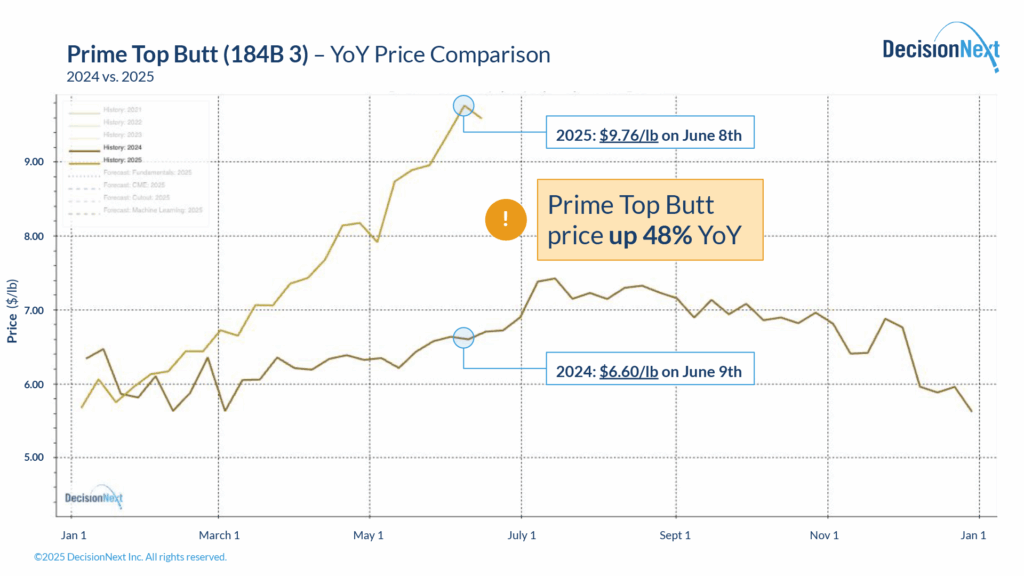

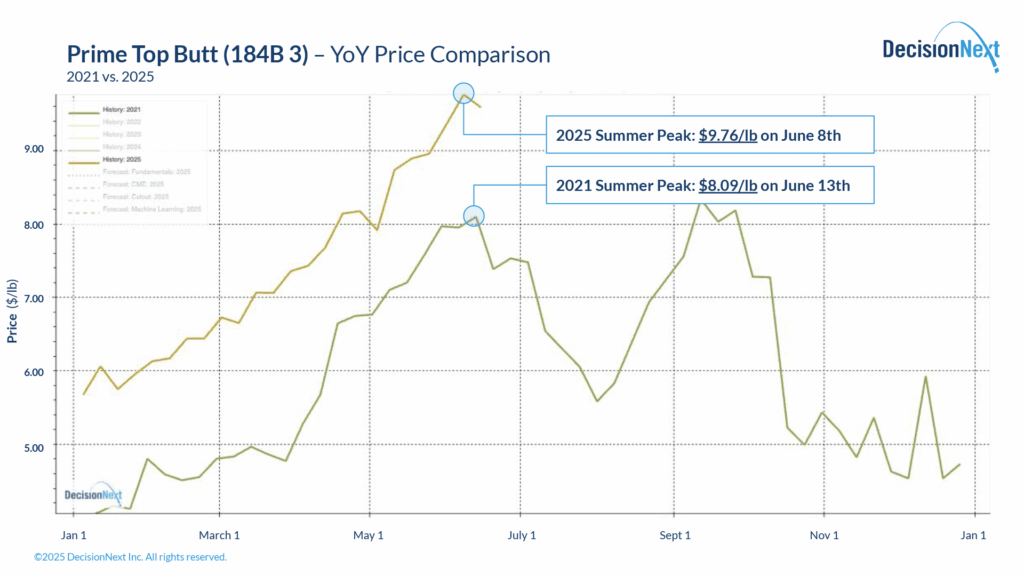

Prime center-cut top butt (184B 3) prices have surged to historic levels, reaching $9.76/lb on June 8th (fig. 1). That price marks an all-time high, surpassing the previous all time highs observed in June and September of 2021 and nearly a 48% price increase year-over-year (fig. 2).

Figure 1 – June of 2025 marks the all time price high for Prime Top Butts, surpassing the previous highs of June and September 2021.

Figure 2 – Prime Top Butt prices are up nearly 50% YoY.

This run-up reflects strong early-summer demand, tight grading spreads, and solid foodservice pull-through. But signs point to a reversal.

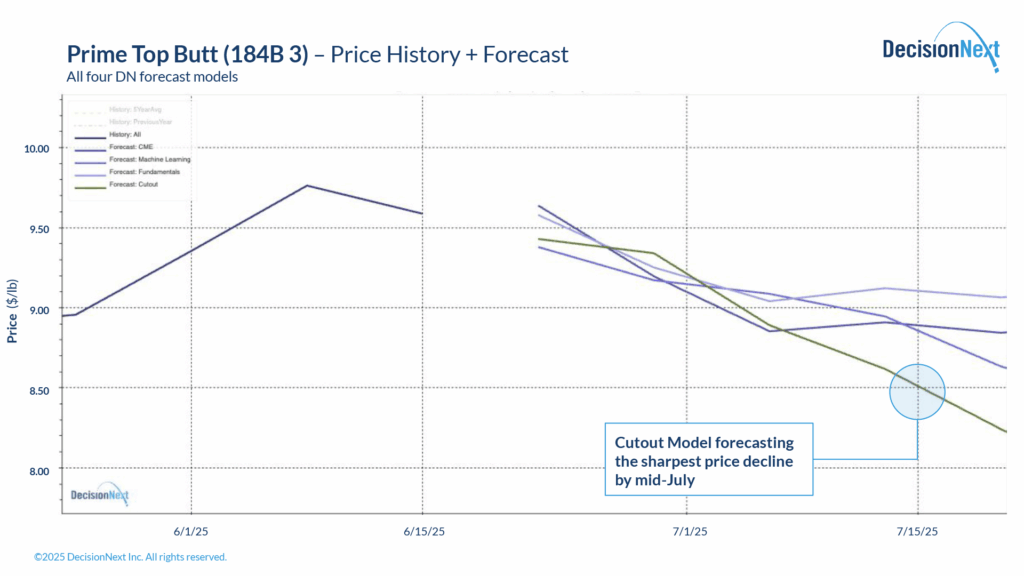

Across all four DecisionNext forecast models, significant price declines are expected by mid-July (fig 3). The Cutout model is forecasting a sharp decline. This model is more sensitive to whole sale supply/demand dynamics as individual cut prices can change more dramatically in response to consumer demand. In contrast, the CME model is calling for a more moderate price drop, as strong cattle prices suggest prices to remain elevated (though still seasonally decline). The contrast in the two forecasts highlights, as well as recent history, show how elevated cattle prices have been driving the beef market higher of late, with the consumer seemingly willing to accept the higher prices.

Figure 3 – Prime Top Butt prices expected to fall into mid-July.

What’s behind the expected drop? A combination of increasing harvest volumes, margin pressure on packers, and the typical post–Fourth of July slowdown in premium loin demand.

For buyers, this may be a strategic window to secure late-Q3 volumes at more favorable price points. For packers, the challenge lies in navigating shrinking cutout margins. And for retailers, the reset that follows the summer grilling season may open up new promotional opportunities.

Of course, Prime Top Butts are not very widely traded. If you want to see this same exercise play out for choice top butts or some other cut, contact us and we would be happy to assist you.