If you’re buying pork for a processing plant, distribution center, or foodservice operation, you’ve probably noticed something: the relationship between live hog prices and individual pork cut prices isn’t what it used to be. Some cuts track hogs closely. Others seem to operate in their own universe. And that variability creates a forecasting problem.

The question isn’t whether you need better forecasts—it’s whether you’re using the right forecasting approach for each cut you’re buying. Because the data shows that one model can’t do it all.

Why Correlation Matters

Some pork cuts track closely with live hog prices. Others don’t. Understanding this relationship tells you whether a hog-based forecasting model will work for a given cut—or whether you need a different approach entirely.

Visually, correlation is easy to spot: when two price lines track together on a chart, correlation is high. When they diverge or move independently, correlation has broken down.

To understand how this plays out in practice, we examined four specific pork price series—each representing one of the four major pork primals: ham, loin, and rib as well as a trim series. We selected the highest-volume traded cut from each primal according to USDA data.

The Four-Cut Analysis: What the Data Shows

We analyzed these three major cuts as well as a trim series, tracking them from 2022 through mid-2025 and comparing their prices to the CME Lean Hog Index. The results reveal dramatically different correlation patterns across primals—and dramatically different forecasting needs depending on which primal category you’re buying from.

72% Trim Combo: The Reliable Follower

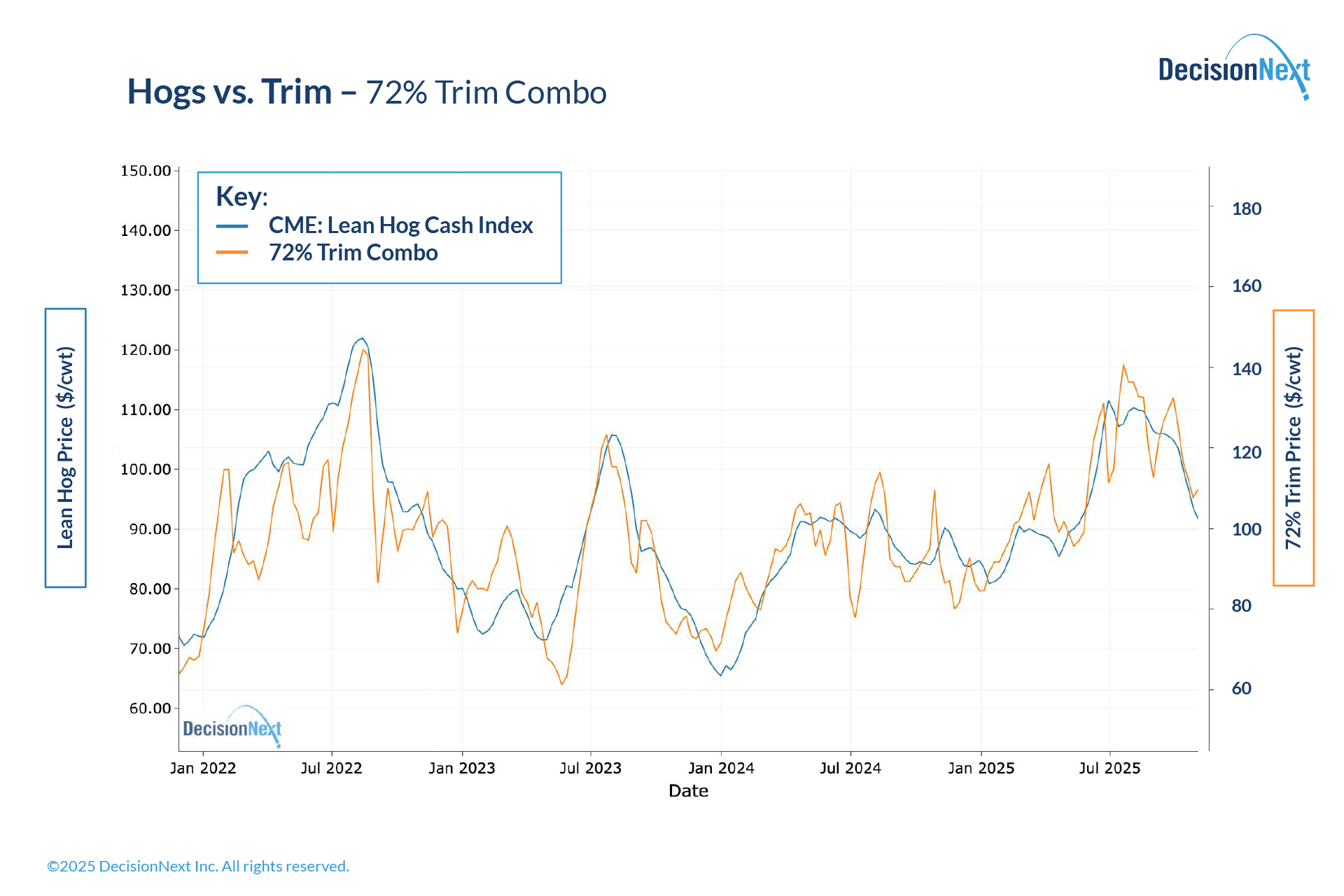

Trim tracks hog prices more consistently than any other cut in our analysis. From the 2022 price spike through the 2023 correction and into 2025, trim and hogs move in near-lockstep (Fig. 1). Correlation remains consistently strong throughout the period.

Figure 1 – CME Lean Hog Index vs. 72% Trim Combo (2022-2025). Trim prices track hog prices consistently throughout the period, demonstrating strong correlation and minimal divergence.

This makes intuitive sense. Trim is a commodity input used primarily for ground pork and sausage production. Its value is driven by overall pork supply rather than specific consumer demand for a branded retail cut. When hog supplies tighten, trim prices rise. When supplies loosen, trim falls. The relationship is direct and stable.

Forecasting implication: Hog-based models work well here. If you’re buying trim, anchoring your forecast to CME futures or cash hog fundamentals will give you reliable directional guidance over the medium and long term. Short-term, there can be meaningful divergences which can present buying and selling opportunities.

23-27# Selected Ham: The Amplified Follower

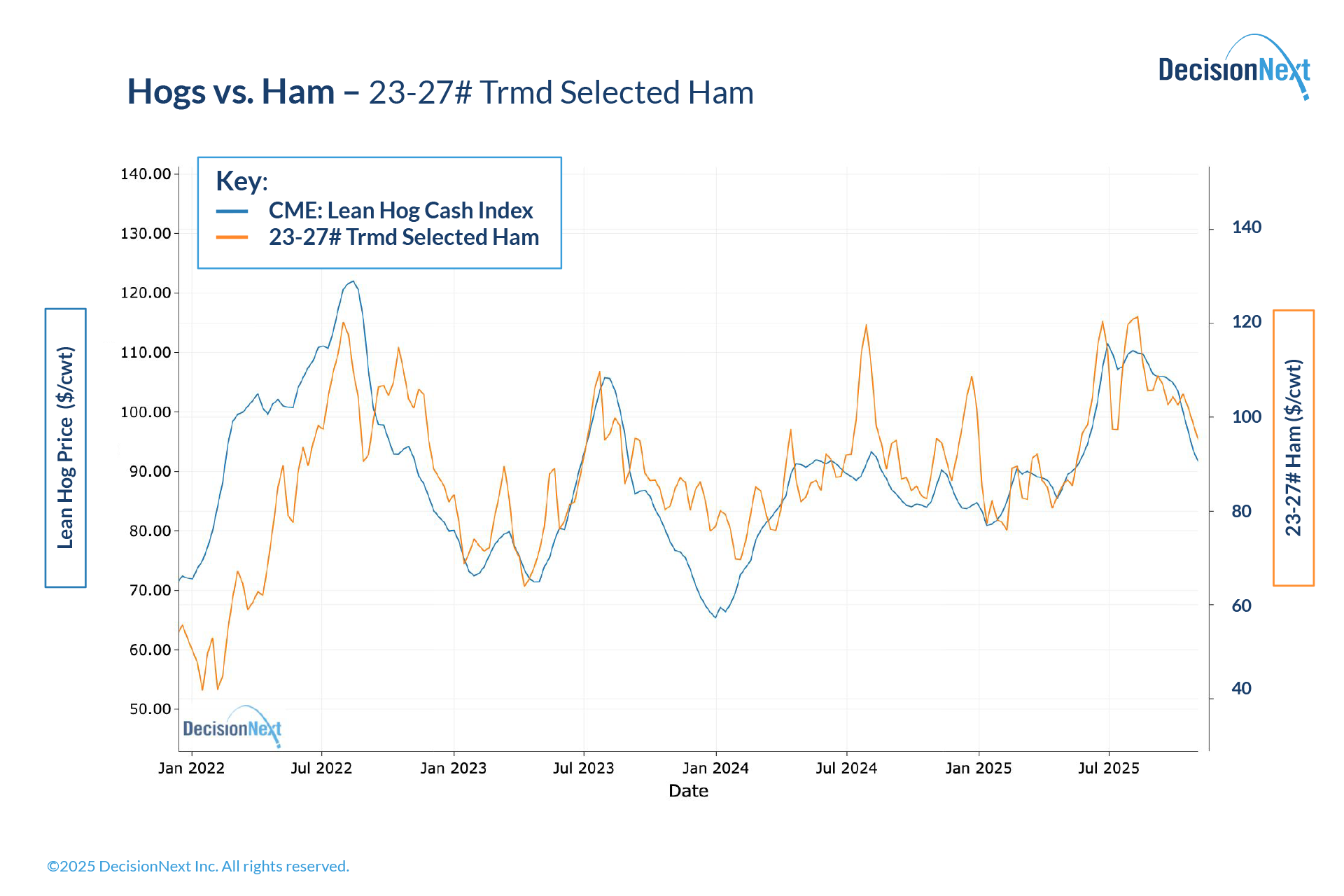

Ham generally follows hog price trends but with higher volatility. In mid-2022, hog prices spiked—but ham prices spiked even more dramatically and remained elevated for longer. In early 2023, when hogs corrected downward, ham crashed harder. Through 2024, the two series tracked closely, but ham’s moves were consistently larger in magnitude.

Figure 2 – CME Lean Hog Index vs. 23-27# Selected Ham (2022-2025). Ham prices generally follow hog price trends but with amplified volatility, showing larger magnitude moves both upward during spikes and downward during corrections.</small.

This amplification reflects ham’s exposure to seasonal demand cycles—particularly holiday peaks—and export market dynamics. Ham isn’t just a generic pork input; it’s a destination product with its own demand drivers. When those drivers align with hog fundamentals (as in late 2023-2024), correlation strengthens. When holiday buying or export shifts dominate (as in mid-2022), ham decouples and overreacts.

Forecasting implication: Hog-based models provide a useful baseline, but you need to layer in cut-specific factors—particularly seasonal adjustments and export demand signals. A single model approach will underestimate volatility.

Sparerib MED: The Seasonal Drifter

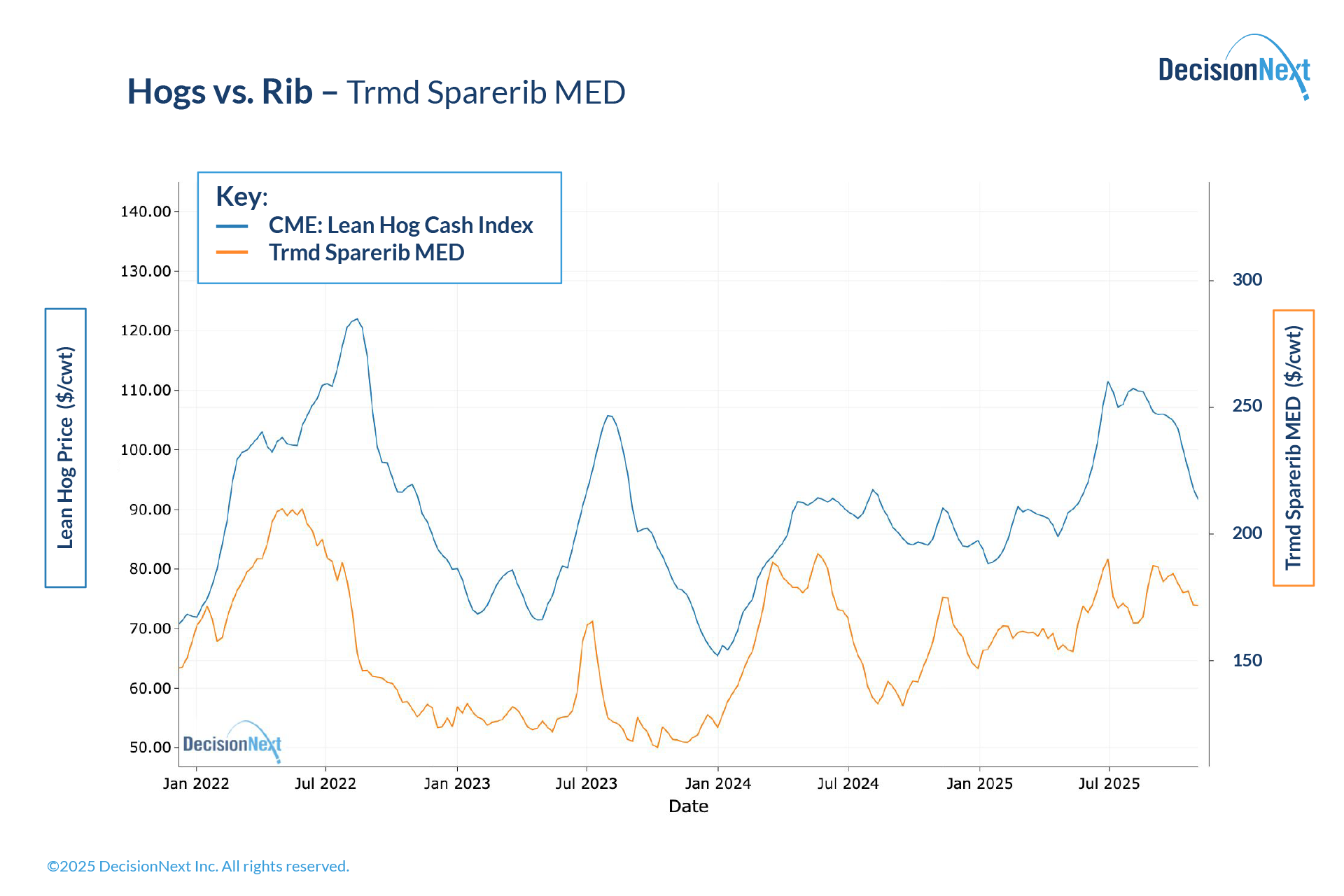

Spareribs show the most variable correlation pattern of the four cuts. In early-2022, spareribs tracked hogs reasonably well. But then the price of hogs spiked dramatically while the price of spareribs dropped seasonally. From late 2022 through the end of 2023 the series track closely. Note that the two series show significant divergence in the summers of 2024 and 2025.

Figure 3 – CME Lean Hog Index vs. Sparerib MED (2022-2025). Spareribs show variable correlation with hog prices, tracking closely in some periods (late 2022-2023) but diverging significantly during others (summers of 2024-2025), reflecting strong seasonal demand patterns.

This variability reflects spareribs’ strong seasonality. BBQ season drives rib demand in ways unrelated to overall pork supply. When grilling demand is strong, ribs decouple upward. When foodservice sales soften outside peak season, ribs can drift lower independent of hog moves. The result is a correlation coefficient that swings from strong to weak and back again depending on the time of year.

Forecasting implication: You can’t rely on a single model here. During periods of strong correlation, hog-based forecasts work. During decoupling periods—which can last months—you need alternative approaches that capture rib-specific demand patterns. If your model doesn’t flag when correlation has broken down, you’re forecasting blind.

Boneless CC Strap-On (Loin): The Independent

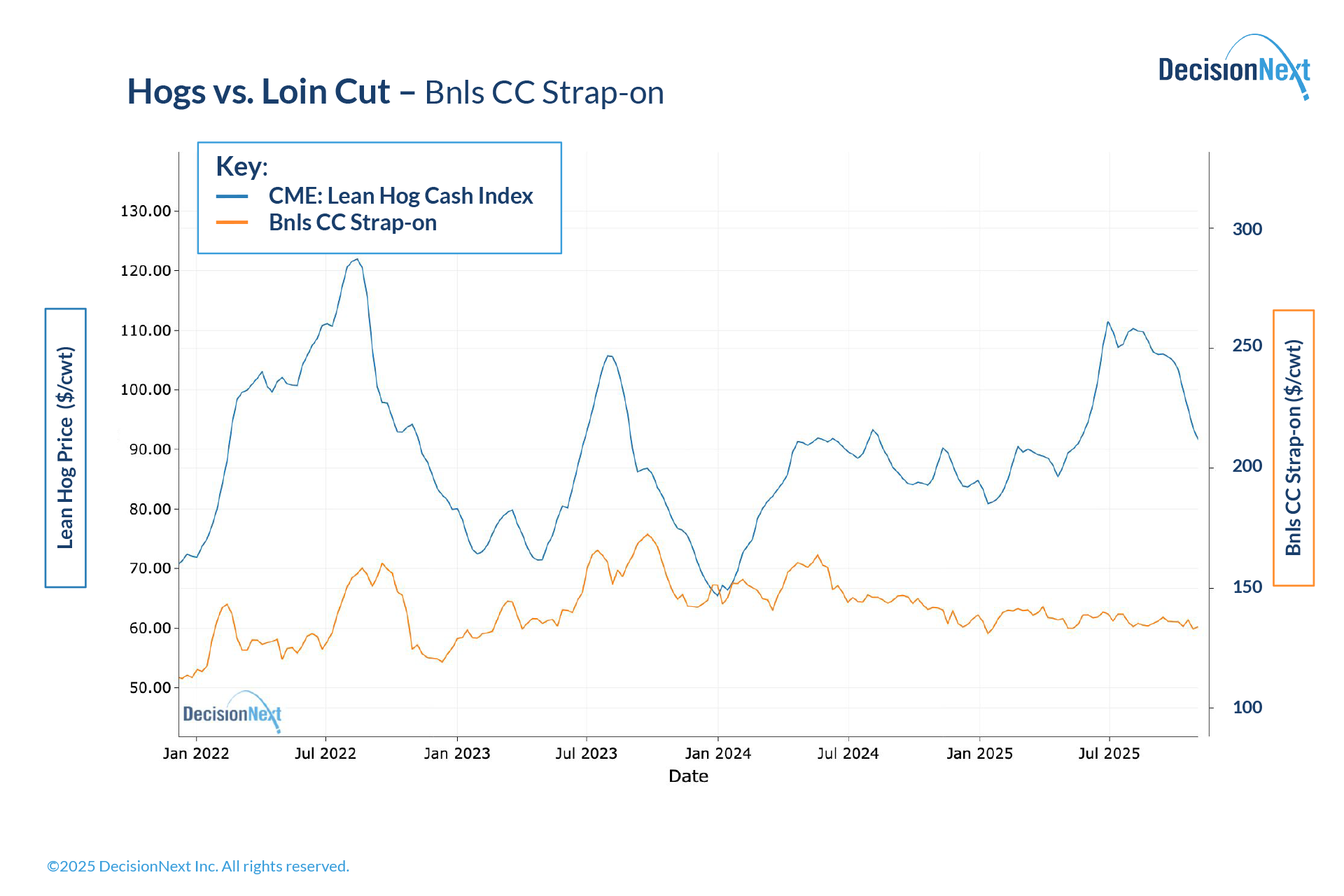

Loin cut prices show minimal relationship to hog prices throughout the entire 2022-2025 period. While hogs spiked and crashed and recovered, loin prices remained remarkably flat and range-bound, oscillating within a narrow $60-70/cwt channel with little regard for what hogs were doing.

Figure 4 – CME Lean Hog Index vs. Boneless CC Strap-On Loin (2022-2025). Loin prices show minimal relationship to hog prices throughout the period, remaining remarkably flat and range-bound within a narrow channel with little regard for hog price movements.

This independence reflects loin’s position as a premium retail cut with distinct demand drivers. Loin competes with chicken breast and other center-of-plate proteins in the retail case. Its pricing is more sensitive to consumer spending patterns, competing protein prices, and retailer merchandising strategies than to hog supply fundamentals.

Forecasting implication: Hog-based models provide almost no value for loin. If you’re trying to forecast loin prices using CME futures or cash hog trends, you’re using the wrong tool. You need models built on loin-specific data—retail pricing trends, competing protein spreads, consumer demand indicators—that capture the cut’s actual price drivers.

What This Means for Your Procurement Strategy

The core insight from this analysis is simple but consequential: one forecasting approach doesn’t work for all pork cuts.

For high-correlation cuts like trim, a hog fundamentals approach is both appropriate and effective. Use CME futures, watch cash hog markets, and incorporate supply-side factors like slaughter pace and carcass weights.

For variable-correlation cuts like ham and spareribs, you need multiple perspectives. A hog-based model provides baseline direction, but you must supplement it with cut-specific models that capture seasonal patterns, export demand, and competing protein dynamics. When correlation is strong, the models should agree. When correlation breaks down, the cut-specific model becomes your primary guide.

For low-correlation cuts like loin, abandon the hog anchor entirely. These cuts require forecasting frameworks built from the ground up on cut-specific data and demand signals. Trying to extrapolate from hog prices will lead you astray.

The practical takeaway: track correlation over time for each cut you buy. When correlation is high, simpler hog-based models suffice. When correlation weakens, that’s your signal to shift to alternative approaches. The buyers who succeed in this environment aren’t the ones with the single “best” model—they’re the ones who know which model to use when.

Looking Forward

Pork pricing complexity isn’t going away. The structural shift from negotiated-hog-based to cutout-based hog pricing formulas fundamentally changed how prices are discovered in this market. Individual cuts now have significantly more pricing independence than they did a decade ago.

That independence creates opportunity for buyers who adapt their forecasting approach to match the reality of each cut’s price behavior. The data tells you when to trust hog fundamentals and when to look elsewhere. The question is whether you’re listening.