Australia’s Lean Beef Gains Ground in the U.S. Market

Published: October 6, 2024

It’s no secret that there’s a tightening U.S. cattle supply that’s pushing lean beef prices higher than ever before. This has many in the industry seeking other, more affordable options. Australia’s lean beef imports are shaping up to offer trim buyers a lifeline, helping them better deal with the high costs. See how international trade is changing the U.S. beef market and why Australian 90CL beef is becoming a key player in cost-effective ground beef production.

A Tale of Two Trims: How 90CL and 50CL Shape the Beef Market

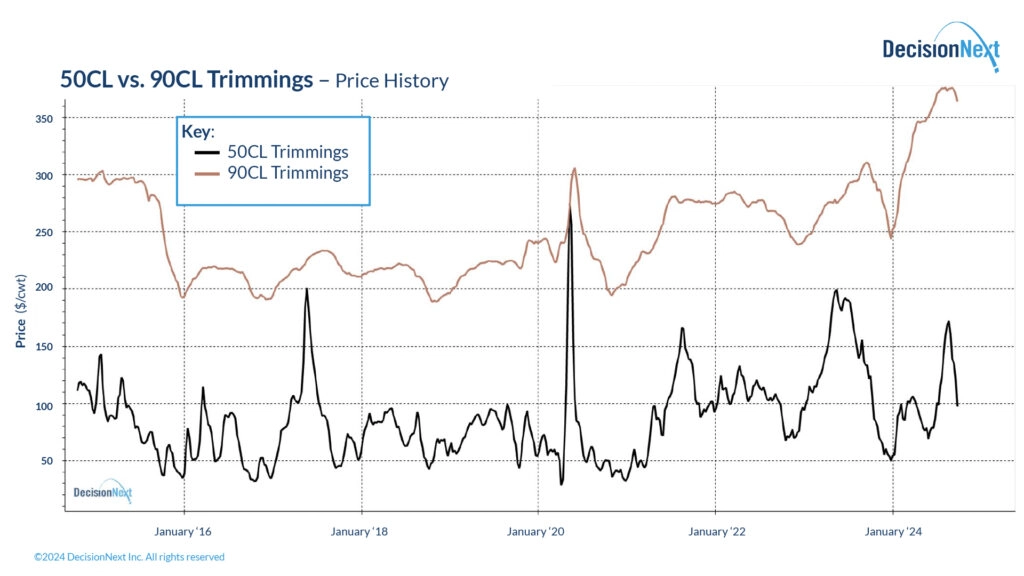

The U.S. beef trim market is dominated by two major lean points in terms of wholesale volume. The first is 90CL (Chemical Lean) trim, made up of 90% lean muscle and 10% fat, which comes mostly from cull and dairy cows. And then there’s 50CL, composed of 50% lean muscle and 50% fat, which is primarily sourced from fed steers and heifers. These lean points serve distinct roles within the broader beef market, with the leaner trimmings commanding a significantly higher price point (Fig. 1). The 90CL variety is the dominant input to produce leaner beef blends, while the 50CL is used for mixing into value added products with higher fat content. These two categories are an important component of the U.S. beef market, linking supply and demand dynamics to the specific types of cattle being processed.

Figure 1 - Price history of 50CL and 90CL beef trim over the past decade.

Why Lean Trim Buyers Are Turning to Australia

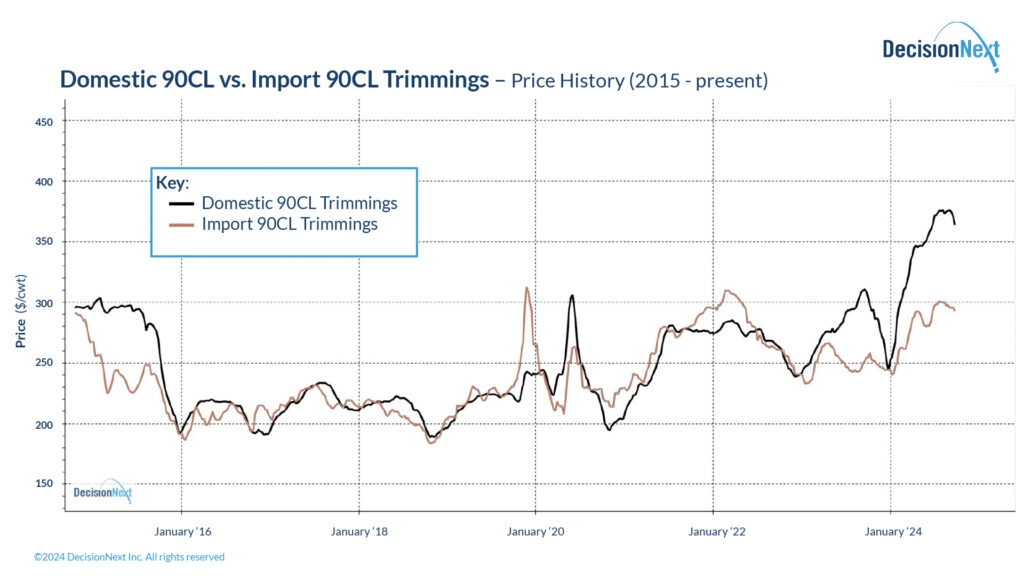

The supply of 90CL has been under a lot of pressure in recent years. Since 2020, problems in the supply chain, droughts, and cyclical herd dynamics have caused a significant drop in the number of cows in the U.S. herd. This means there are fewer cows available for slaughter today. As a result, the supply of 90CL has become limited, and that in turn has driven prices up. With fewer cows being slaughtered, it’s harder to find U.S. domestic 90s, making them more expensive and creating challenges for buyers who need lean beef.

Amid this supply squeeze, Australia has emerged as a critical provider of lean beef to the U.S. market. Australian grass-fed cattle are generally leaner than the grain-fed cattle that are common in the U.S. This makes them a good fit to help fill the gap in the supply of 90CL.

Figure 2 – Comparing the price history of domestic 90s with Australian imported 90s.

Figure 2 – Comparing the price history of domestic 90s with Australian imported 90s.

Also, the strong U.S. dollar compared to the Australian dollar has allowed Australian lean beef to enter the U.S. market at competitive prices. Lower cattle costs in Australia also contribute to these affordable prices. These factors have made Australian beef an attractive alternative, especially for buyers looking to secure lean trim at a discount compared to domestic options.

The Financial Advantage of Australian 90CL Trim

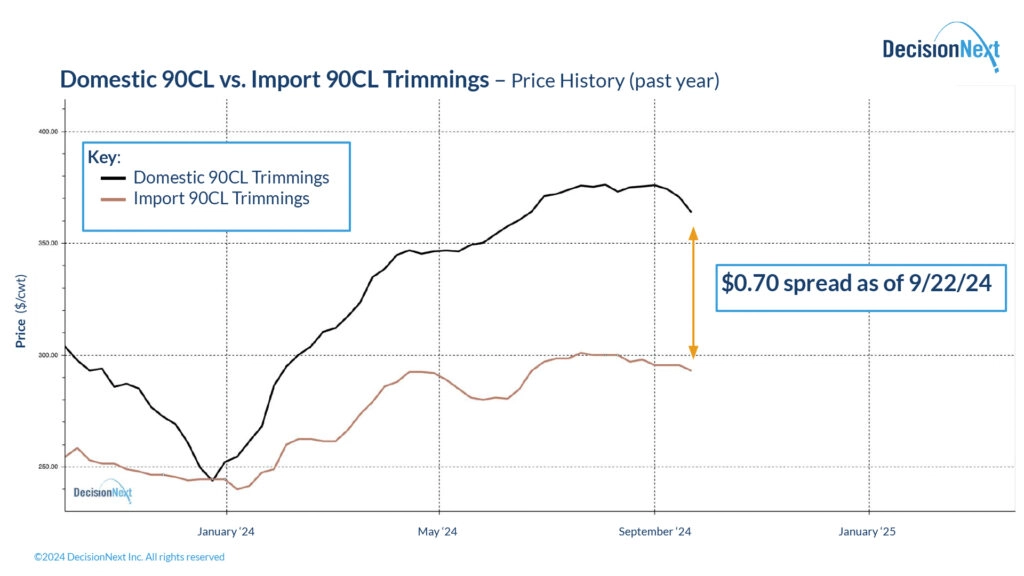

Australian beef imports have become a vital tool for U.S. buyers to manage costs and ensure supply in the market, giving them a big advantage when purchasing lean cuts. By choosing Australian 90CL, buyers can achieve substantial cost savings compared to sourcing domestic 90CL. As of 9/22/24, there’s a $0.70/lb difference in price between domestic and imported options.

Figure 3 - There was a $0.70 spread between domestic and imported australian 90s as of September 22nd.

Figure 3 - There was a $0.70 spread between domestic and imported australian 90s as of September 22nd.

The pricing differential between domestic 90s and Australian imports makes it financially appealing, especially when blended with cheaper U.S. 50CL or 65CL trims, as well as trim from Australia at other lower lean points. This approach not only reduces overall production costs for ground beef blends, like 75% lean patties, but also provides more stable access to lean cuts, even when U.S. supply is constrained.

Conclusion: Making Smarter Decisions Starts Here

As the U.S. beef market continues to face challenges posed by a tightening cattle supply, Australian 90s represent a smart, cost-effective choice for trim buyers. For those willing and able to adjust their sourcing strategies, this option helps protect against market unpredictability while providing high-quality lean beef.

However, the future remains uncertain due to various market factors. For instance, have you considered alternative trim options if ports close? What can you source economically within the U.S.?

To navigate this ever-changing environment and improve your forecasting decisions, the DecisionNext platform is here to help. Our advanced analytics platform allows buyers to analyze different scenarios, so you can make smarter, more informed decisions. This way, you can effectively manage your business and safeguard against market uncertainties while securing quality products.

Discover what DecisionNext can do for your business—schedule a demo today.

Sign up for our FREE newsletter, The Formula.

The Formula is DecisionNext’s monthly newsletter for industry insights, product updates, company news and more!