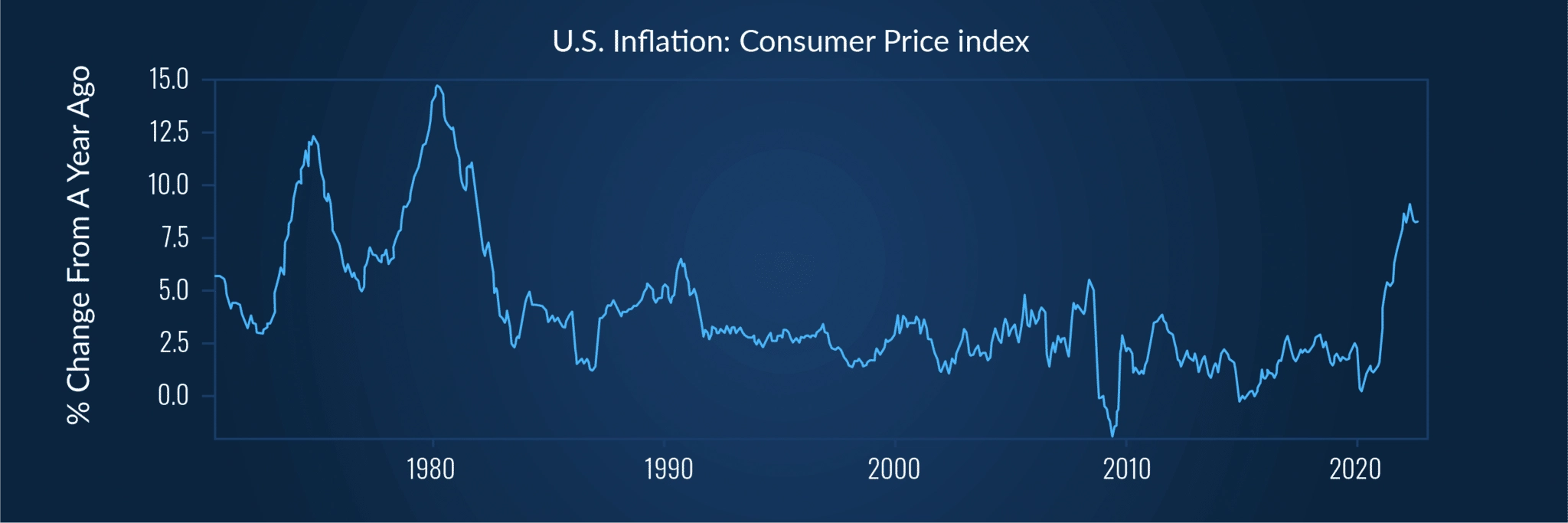

Can inflation measures be used to forecast meat prices

Published: November 4, 2022

Persistently high inflation and other macroeconomic trends are contributing to financial instability and volatility across global markets. But to what extent can inflation measures and other macroeconomic indicators be used to forecast meat prices? Our team found some problems with including inflation variables in some key forecasting methodology. Read on to learn more.

Leveraging the DecisionNext analytics platform, users are given full access to our curated forecasts, which means they can not only see where markets are expected to head but they can actually drill down and examine the variables driving the projected outcomes. From these models, users can layer macroeconomic variables (such as inflation expectations) onto the forecasts, and then run simulations to see how these variables result in different scenarios. Importantly, users have access to backtesting in order to test the historical accuracy of the models that they have selected.

This modeling approach allows users to test assumptions to identify the most impactful variables included in any given model, a cycle which allows both the models and the users to improve over time.

This is exactly what our data science team did to measure the effects of inflation expectation metrics on beef and pork forecast models.

After analyzing the results of multiple machine learning forecast models, it became clear that the inclusion of macroeconomic variables cause models to overfit to historical observations, leading to larger absolute forecast errors for both beef and, to a lesser extent, pork markets.

The results suggest that the predictability of wholesale meat prices continues to be driven by market-specific fundamentals such as harvest and consumer demand as opposed to broader macroeconomic trends like inflation.

This is at least partially attributable to the fact that these macroeconomic variables are embedded within the decisions driving the markets for meat. For example, the demand for wholesale consumer beef volume would include expectations around macroeconomic variables. By explicitly layering additional macro variables into the forecast, it ends up “double counting” these factors, causing increased forecast errors.

To maintain the most accurate models for beef and pork wholesale prices, it is imperative not to overweight macroeconomic variables. At the same time, it is important to constantly test and evaluate forecasts, and by not just providing a blackbox forecast, DecisionNext users can evaluate the impact of a range of variables on any forecast, at any time.

Fill out the form below to read the full article, an in depth empirical assessment of inflation indicators and predictive ability for commodity markets.

[gravityform id=“13” title=“false” description=“false”]