It’s no secret that our business runs in cycles—and that’s especially true at the wholesale level. We’ve all learned to ride the waves of the seasons. For example, Easter hams boost formula pork sales in November, while Fourth of July cookouts lead to formula ground beef bookings in May and June. And Holiday Ribs, in turn, drive rib deep chill and formula booking in July.

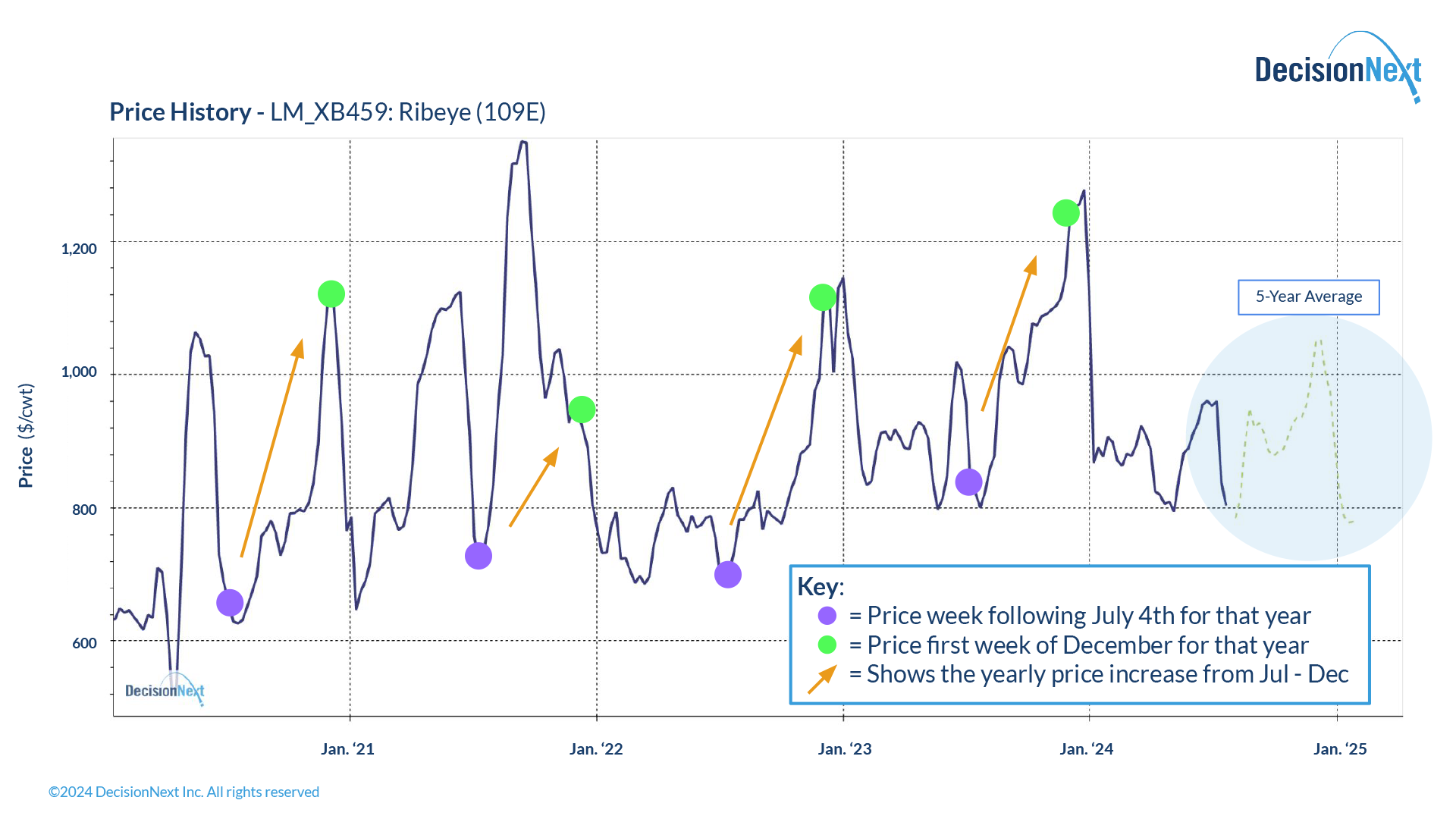

Wholesale ribeyes (109E) usually follow a predictable pattern, with their price bottoming out just after the Fourth of July. They then rise steadily through the first week of December before dramatically falling off at the turn of the new year (Fig. 1).

Figure 1 – The price of ribeyes (109E) follows a seasonal pattern, bottoming out after July 4th and rising steadily through mid December.

Conventional wisdom drives buyer behavior. The earlier you procure the item, the cheaper it will be resulting in the largest gross profit.

But does buying at the cheapest point in the cycle actually result in the largest gross margin?

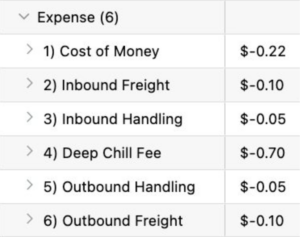

After all, buying Holiday Ribs in July means that you have to hold that inventory in deep chill through the end of November. Consider all of the other expenses associated with this strategy: cost of money, inbound freight, inbound handling, deep chill fee, outbound handling, outbound freight, and more (Fig. 2). It all adds up fast.

Note: Don’t focus so much on the dollar amount of the expenses, but rather on the list of expenses and how they affect the net profit in Figure 3. These tables are customizable, both in terms of the list of expenses and the dollar amounts associated.

Figure 2 – List of expenses associated with a procurement strategy that relies on holding inventory in deep chill.

Most retail buying departments understand this tradeoff between the price of the product and the cost of the handling fees. In theory, this tradeoff makes sense, but the reality is they don’t have a tool which allows them to run the calculations for the upcoming year. So they play it safe, repeat what they did the previous year, operate by rule of thumb, follow their hunches, and buy the product when it’s at its lowest.

But what if there was a tool that empowered them to actually run the math?

Expenses may be out of sight, but net profit isn’t out of mind.

In the case of Holiday Ribs, the low ribeye prices seen in July and August often hide the real costs involved. DecisionNext offers a leading AI platform that helps companies buy or sell commodities at the right time. It lets you put everything into one equation, use a best-in-class forecast, and easily adjust costs for deep chilling.

Let’s take a look and see how that would have played out this year.

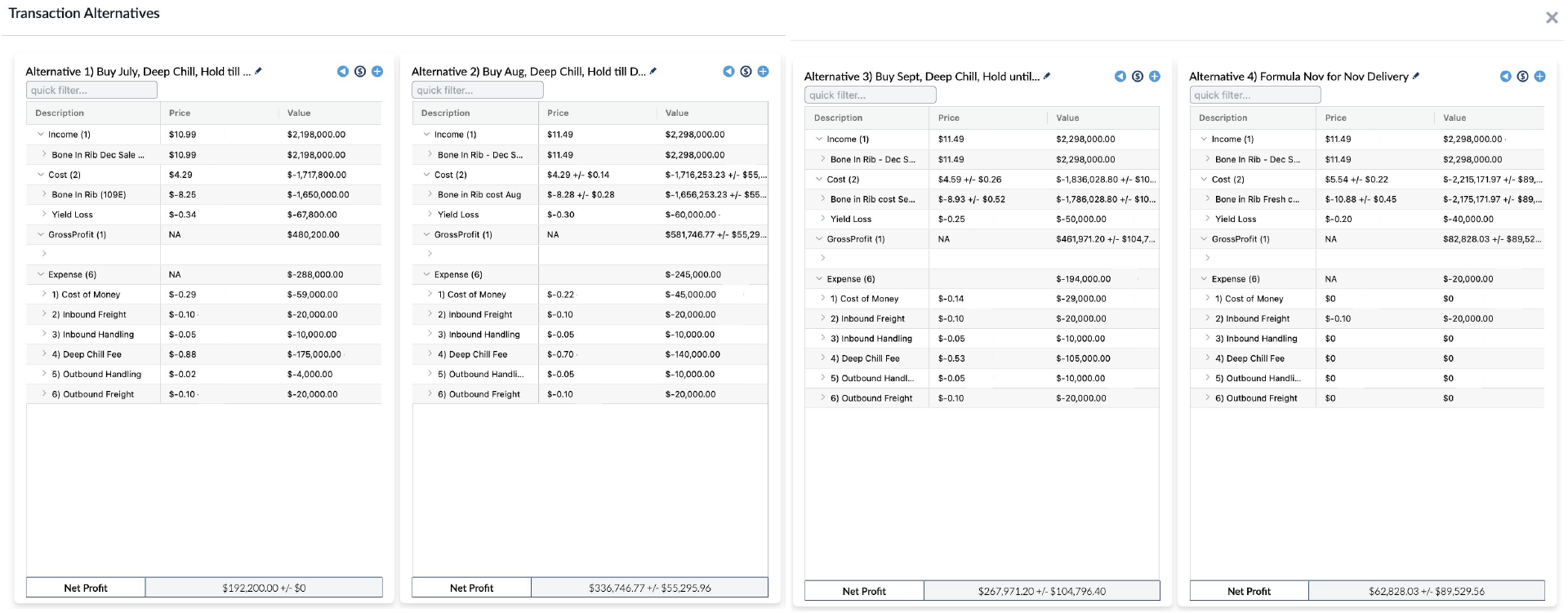

Figure 3 is a screenshot from the DecisionNext Transaction tool. It shows you how you can easily compare all the different deal structure alternatives. You’ll also notice how it takes all of these additional expenses into account:

- Alternative 1: Buy in July, Deep Chill, Deliver Nov/Dec

- Alternative 2: Buy in Aug, Deep Chill, Deliver Nov/Dec

- Alternative 3: Buy in Sept, Deep Chill, Deliver Nov/Dec

- Alternative 4: Buy on formula, Deliver Nov/Dec

Figure 3 – In the DecisionNext Transaction Application, users can easily compare different deal structure alternatives, taking seasonality and additional expenses into account.

We started this evaluation for a customer in June, closely monitoring how the price forecast for Ribeyes would impact their net profit under four different deal structure alternatives. Reach out to info@decisionnext if you would like an up to date version of this graph with updated net profit forecasts for September and November.

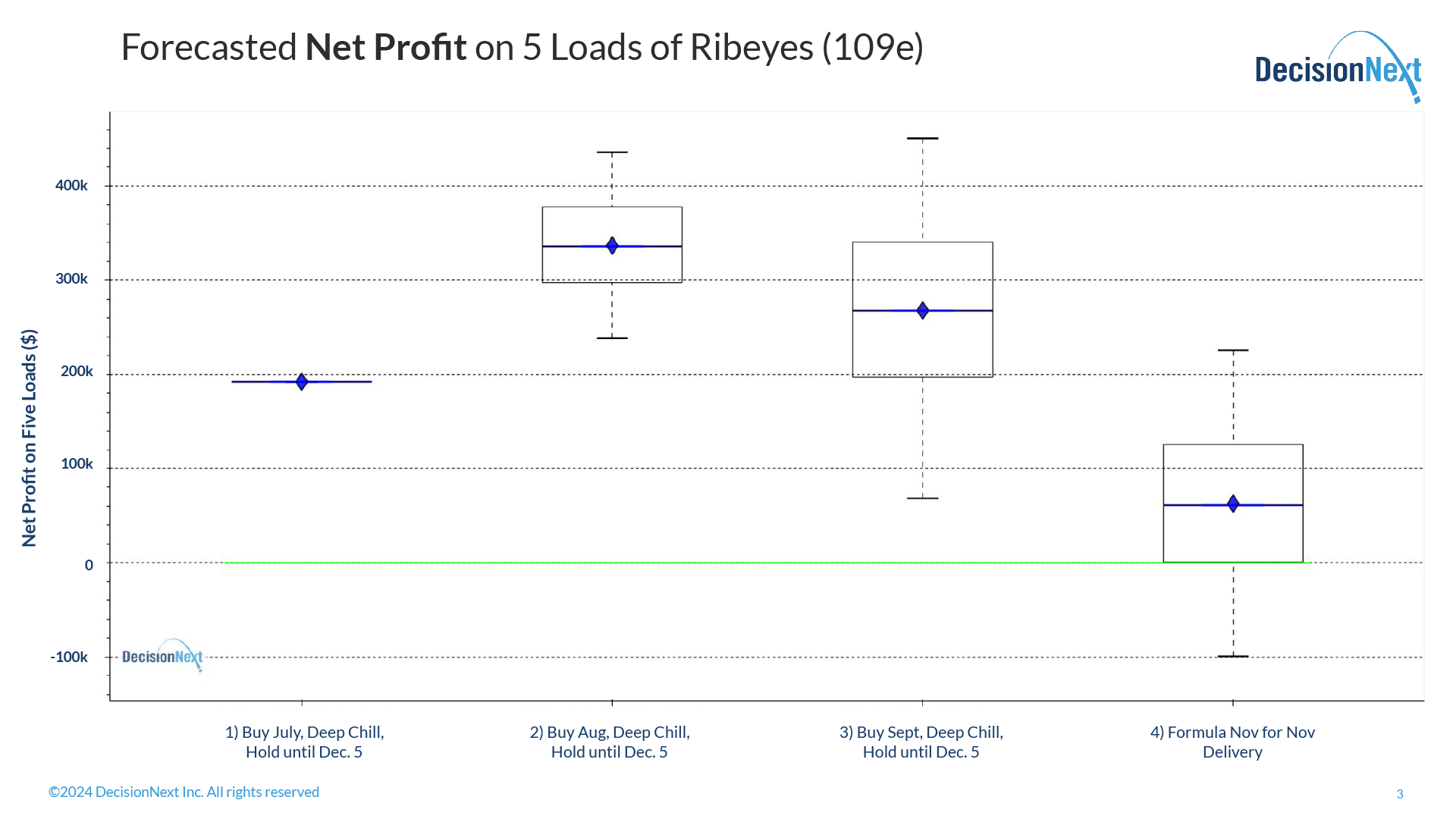

The traditional practice is to buy Ribeyes in July which usually gets you the lowest price. But like this year proved, that isn’t always the case. The problem is that the price bottomed out in July, rose through August, and is expected to continue to rise through the holidays. Buying in August goes against typical thinking, but would have resulted in a higher net profit (Fig. 4). And buying in September will likely result in an even higher net profit as well, although that remains to be seen.

Figure 4 – Net profit comparison of four different holiday rib buying alternatives run in early August 2024.

Navigating the most economical time to buy is easier said than done.

The old “reliable” methods just aren’t cutting it anymore. This Holiday Ribs example showed that live real-world data tells a different story. The hidden costs of holding inventory—such as deep chill fees and handling charges—can quickly skyrocket and impact your bottom line.

You need a new approach to evaluating different deal structure alternatives.

That’s where DecisionNext comes in. Our advanced platform goes way beyond rule of thumb and empowers buyers to analyze different scenarios to make smarter decisions in a single equation. So you can manage procurement better and increase your net profits.

To see how you can make more accurate and strategic buying decisions, consider incorporating DecisionNext into your approach. Contact us at info@decisionnext.com.

Sign up for our FREE newsletter, The Formula.

Every month you’ll get a Finished Good Report along with a deep dive, so you can start to track important trends over time.