DecisionNext. Decide Better.

Navigating today’s volatile commodity markets.

Competing effectively in commodity spaces within the food industry has never been more challenging. People who are experienced in pricing, purchasing, and risk management are continually looking for ways to improve their processes and manage risk. While there are a number of ways this can be done, having the entire process covered from buy to sell is the best way to ensure success. That’s where DecisionNext separates itself from the pack.

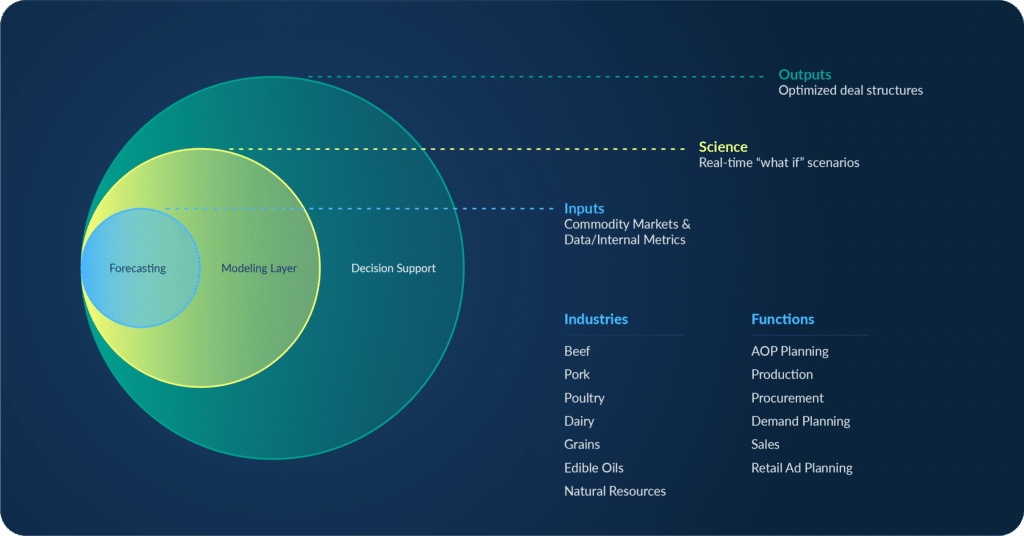

Below is a snapshot of how the DecisionNext platform works.

Forecasting:

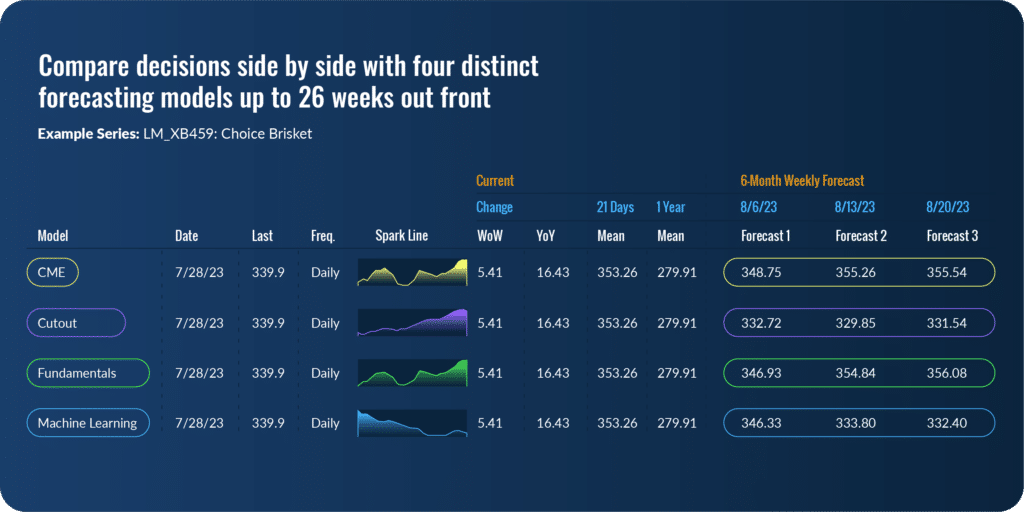

At the core of what we do sits a powerful, machine-learning market forecasting platform. Tested, validated, and always learning, this tool gives our customers daily-updated market views across multiple perspectives — simultaneously. The platform is built to interact with data (proprietary internal, third-party, and publicly sourced) from across all commodities, from minerals, to feed, to primals, to finished goods. This is one example of how DecisionNext works within the animal protein space, offering four distinct forecasting models:

CME Forecast: Takes the forward curve (futures prices) for key traded commodities (hogs, live cattle, or corn for example). For specific meat cuts or geographical locations different from delivery, add or multiply a spread/ratio to get product-level forecasts tied to industry benchmarks. For commodities not traded, weighted baskets of futures contract to provide hedging and broad market perspective.

Fundamentals Forecast: Using our proprietary technology and market experts, DecisionNext searches for the econometric supply/demand driver variables (corn, soybeans, freezer stocks, etc.) that have the most predictive power for the price of cattle or pork, and then uses a ratio to determine the price of the cut (brisket, pork bellies, etc.).

Machine Learning: A mathematical approach which analyzes seasonality, price history, trend, and the AI-selected data points for the specific cut in question, using millions of simulations to forecast its future price.

Cutout Forecast: A beef-specific fundamental model that combines live cattle forecasts with forecast variables that explain the variation between the price of cattle and beef values. Similar to CME, forecasts for cut are made by multiplying a cutout forecast by a ratio, but in this case, a ratio of cut to cutout.

Of course, testing the historical accuracy of the three distinct models for a specific item is important. The DecisionNext platform affords users the ability to backtest these models at any time, and determine which one works best for their specific needs and important decision-making time horizons. User interaction with the forecast models is a unique differentiator, ensuring that DecisionNext forecasting is never a black box.

Modeling Layer:

Scenarios: Once users gain confidence with the forecast, DecisionNext allows them to run real-time “what if” scenarios about the impact of events on future pricing. For example, users can input what they know to be true about the demand of an item, such as beef briskets, and model out the impact of 25 loads being booked and taken out of the spot market in coming weeks. Retailers, distributors, processors and other market participants with specific insight into future events can measure that impact right from their desktop.

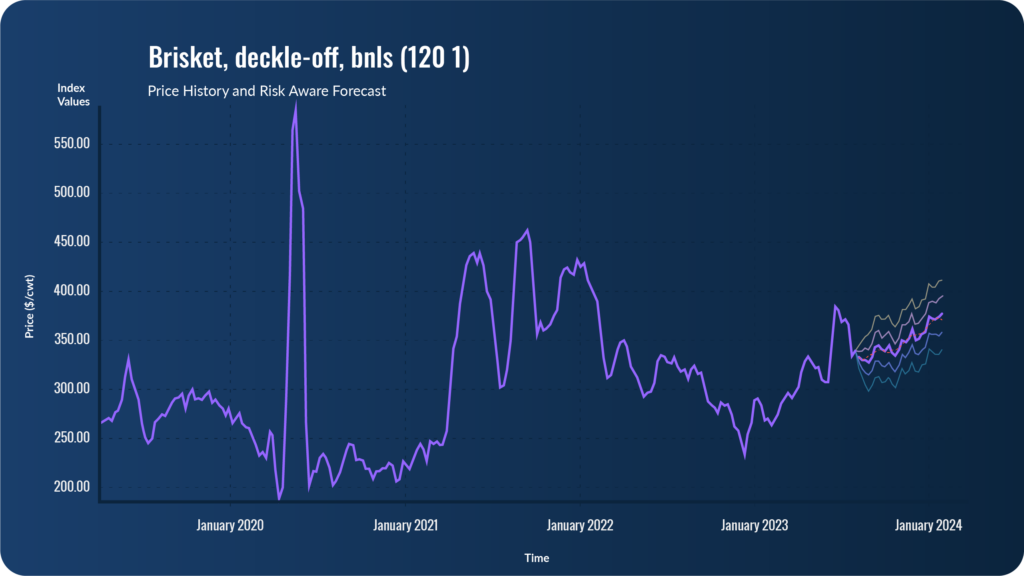

Certainty: Forecasting a specific price at a given time is one thing, but understanding the certainty of the forecast is necessary for making the right decisions. DecisionNext gives users the ability to see how confident they should be in a forecast by showing the confidence intervals between the expected high and low price for an item. Some cuts are more volatile than others and some models perform better than others — we’ll show you what that means in terms of upside and downside risk.

Expertise: You have experts in your organization, and what they know matters to the business. DecisionNext and the modeling layer give them the platform to use that knowledge to make the best decision. No more spreadsheets and guess work.

Decision Support:

Now it’s time to take the forecasts and build some buy/sell alternatives. What separates DecisionNext from traditional forecasting and modeling platforms is our Transaction module. Knowing which specific buy or sell decision best fits your risk profile for a given deal is where things get really impactful.

The DecisionNext Transaction module uses the forecast and associated risk profile to model expected cash flows for each decision, all the way down to the gross margin level. Customizing each decision with variables such as freight, storage, toll, formulations for finished goods, etc. makes the tool incredibly flexible. This module works for all types of buy/sell transactions and business types.

Build a Library:

Users format and store various commonly-used deal scenarios and customized timeframes for things such as buy/sell options, hedging strategies, and risk-sharing structures with suppliers/customers which adds confidence that the deal is right for them. Each future decision is only a few keystrokes away.

What’s more, after the deal is made we can watch how it performs and scorecard the decision.

The advantages include:

- Risk management: Knowing your comfort level with the deal

- Personnel development: Ability to go back and evaluate each deal after the fact

- Succession planning: Building consistency in your operation, making onboarding easier

- Partnership: Turn the screen around with your key partners to analyze the best deal

Finally, the DecisionNext Customer Success team is there for each step of the process, building and maintaining your models so that your organization can realize value from Day 1. Our customized business support options are designed to work for every commodity need, small or large.

Improve your Market Forecasting and Analysis

Complete the quick contact form and we’ll be in touch.