Low feed availability and high feed costs have altered the supply of fed cattle and cows to the market since mid-2020. Cattle prices have continued to climb while the grades of cattle have notably declined. Cow slaughter has also increased in response to high feed costs. On the consumer side of the market, higher incomes and shifting demand allowed packers and processors to pass the high costs of cattle on to beef product prices.

This story of higher cattle and beef product prices has shifted in recent months, as cattle prices have continued to rise while beef cuts and trim prices have receded, or at least not kept pace. Prime-graded beef cuts, and other higher value cuts, are the standout from the rest of the market, as they appear tethered at this time to cattle prices.

In the ground beef market, the outlook question sits, will cattle prices continue to move higher as suggested by the futures market, and if so, will this drive up ground beef prices or will ground beef prices follow their own path? Though the focus here is on ground beef, there are similarities to many other beef cut markets as well.

Contact one of the DecisionNext meat experts to see how we can help you better understand your market segment and purchasing / merchandising plan.

Review of Market Conditions

Diving into current market conditions helps to understand where the market may be headed. Better than anticipated international demand for grain and oilseed exports, expansionary biofuel policies, and drought in regions across the US (as well as supply issues globally) pushed feed prices to levels not observed since 2012. Higher feed costs and low pasture quality has reduced the size of feeder cattle and increased the costs to finish cattle. The consequence of these conditions on the beef market was lower graded cattle and increased cow slaughter. Weekly cow slaughter in 2022 exceeded all previous years on record, surpassing the 2011 high. 2021 was the third-highest weekly slaughter rate on record, only behind 2022 and 2011.

The initial effect of a higher head count but lower-graded fed cattle and increased cow slaughter is an amplified supply of leaner carcasses.

The subsequent effect of slaughter brought forward is an anticipated lower supply in subsequent months. In the longer term, the increase in cow slaughter reduces the ability to increase herd sizes, restricting the possible number of animals in ensuing years. This has notably put pressure on the cattle price. If ranchers observe high feeder and cattle prices, they might switch from culling cows to holding back calves for breeding. This can flip the market from an oversupply of cows to one with not enough. 2014 is the analog many are trying to anticipate, where cow slaughter precipitously fell off from the previous year.

Looking ahead to 2023, the market is expecting to bear the consequence of slaughter brought forward and lowering supplies of cow slaughter, suggesting that lower animal availability will lower slaughter counts in 2023. Before getting there, it is relevant to also touch on the storage market because it is relevant to understanding ground beef.

Storage levels

In anticipation of lower supplies, inventories of boneless beef have risen. During 2022, the typically pronounced decline in inventories during the summer months failed to materialize. The quantity of frozen boneless beef held in storage was at its highest July level on record during 2022. June and July are when storage levels tend to bottom out for the year. Inventories also typically rise in the fall months after the summer dip. Inventories have not risen as much as common, setting storage levels only slightly above seasonal norms. The failure of inventories to grow further despite July highs suggests a combination or one of three outcomes: 1) inventory constraints being met, 2) increased demand for ground beef, and/or 3) lower supply.

Lower supply is unlikely the root cause as cattle and cow slaughter remained high. If a lower supply is coming, it has not happened yet. Increased demand for ground beef is also unlikely because prices of fresh ground beef receded notably from 2022 peaks. However, they do remain above 2019 levels. It is likely that storage only has so much capacity to hold inventories to mediate supply flows. If slaughter remains high and inventories are capped, this would put downward pressure on ground beef prices. A decline in ground beef prices, with below-normal inventory gains, suggests softness in demand relative to supply.

Supply availability

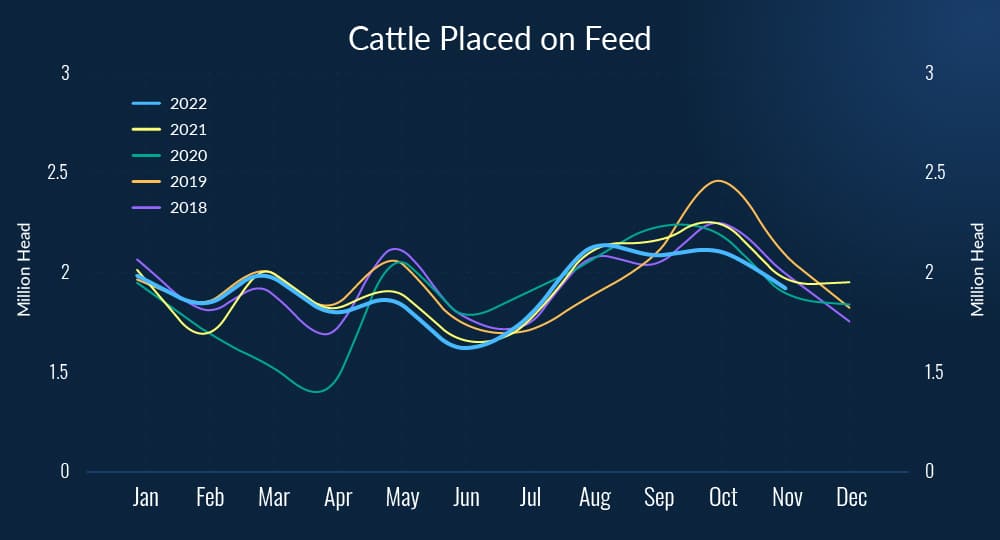

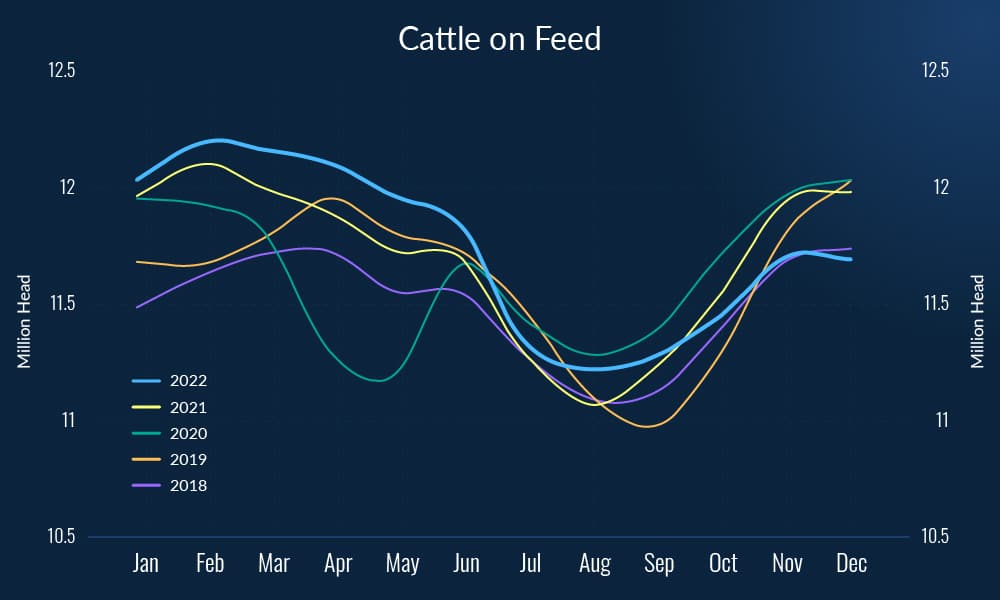

Narrowing in on the uncertainty around cattle and cow supply availability in 2023, the monthly cattle on feed and placement data provide insight into the market in the coming months for beef. The cattle placements on feed during October 2022 were the lowest value on record for that month. However, adding September and October, and the October placements look low, but not as bad. 2012 and 2016 had a lower number placed on feed in the 9th and 10th months of the year. When the November data was released, the year-year level decline was 2.2%. This change is much closer to July 2022 to July 2023 calf inventory changes (-2.5%). The November placement figure was low but above 2020.

Once replacement heifers start being held back, feed placements can differ from calf inventory changes if farms hold back calves for herd building, which the market is looking for. However, the incentives to shift toward a herd-building regime appears sentiment is likely overly preemptive. Feeder cattle prices are high, particularly relative to current feed costs, suggesting this scenario is not outside the realm of possibility. However, we would likely expect larger declines in feed prices before this outcome was to occur at the scale suggested by the October placement figure. Further, we would observe persistent year-year changes exceeding calf inventory changes for an indication of regime shifting. Subsequent months will shed more insight into the 2023 market.

Outlook

Given market conditions and expectations, the question heading into 2023 is why cattle prices are rising while ground beef prices (and most cuts) are receding or trading flat? How long can this reverse correlation last, and which segment will flip: lower cattle prices or higher ground beef?

Strong demand for higher-graded cuts is supporting cattle prices at this time. Further, cattle inventories are lower than observed in recent years, which is showing up in cattle prices. In contrast, however, prices of Choice, Select, and trim have not kept pace, suggesting softening demand. Broader macroeconomic trends of softer consumer demand are supporting the demand story.

Trim prices remain strong but are not expected to track to 2022 levels, particularly in the first half of 2023 when supply remains available. The end-of-year seasonal dip was notably absent in 2021 but not 2022. This is bearish for prices relative to last year’s outlook. The foreshadowed decline in available slaughter is omnipresent but the cattle market has not yet turned, suggesting if price increases were to occur, it is more likely toward the end of 2023. Cow slaughter rates peaked in 2011, three years before the 2014 cow slaughter drop-off. Cow slaughter has not yet rolled over.

In addition to watching the typical market indicators of a potential turn in the slaughter market, the fresh-frozen premium for ground beef will be an indicator to watch in this market, as inventories will soften frozen prices if supply becomes increasingly constrained, but demand remains strong. If a premium does not hold up or build, it is suggestive of softening demand. Look for this and other indicators (slaughter and herd size) to manage the price risk into the fall and winter of 2023.