Navigating the Sale of Spot Cargo for Maximum Gain

Published: August 5, 2024

Value

Using DecisionNext’s advanced forecasting tools, an iron ore producer boosted their profit by $700,000 for one deal. The platform helped them easily improve their decision-making, manage risks, and make critical decisions faster when selling spot cargo. Given that this iron ore producer has at least one of the deals a week, this would lead to an increase in revenue margins by 3-5%.

Problem

Finding the best time to sell gets harder as the complexity of your operation grows. Without the right tools, the right opportunities can pass you by. This is due to several factors:

- Complexity: Geographic arbitrage involves navigating port-specific dynamics, fluctuating fees, and logistical challenges that hinder optimal decision-making and reduce profit margins.

- Time Pressure: Rapid decision-making can set back comprehensive analysis, leading to suboptimal or rushed decisions.

- Inability to Analyze Quickly: Swiftly evaluating pricing can get in the way of making informed trading decisions.

- Rapidly Evolving Market Trends: If a business can’t quickly adapt to changing market conditions, it can hurt how well it performs and how it competes.

- Lack of Structure: Not having a simple, straightforward way to use market information when making sales decisions.

Solution

- Enhanced Decision-Making: Choose the best time to make transactions and pick the right buyers to make more money and reduce risks.

- Timing Strategies: Plan key operations to minimize losses.

- Risk Mitigation: Rigorous modeling to quantify risk and value trade-offs.

- Single Market View: An integrated look at future market trends.

About DecisionNext

DecisionNext is a best-in-class AI platform that empowers companies to buy or sell at the best times, with the best formulas, at the best prices. Built in collaboration with our customers, DecisionNext has revolutionized how price and supply forecasting can improve business decisions. And it’s the only platform that incorporates users’ wisdom in its algorithms! Our case studies illustrate real-world examples of how our platform has helped customers. Please reach out with questions or for a deeper dive into our solutions.

The Scenario

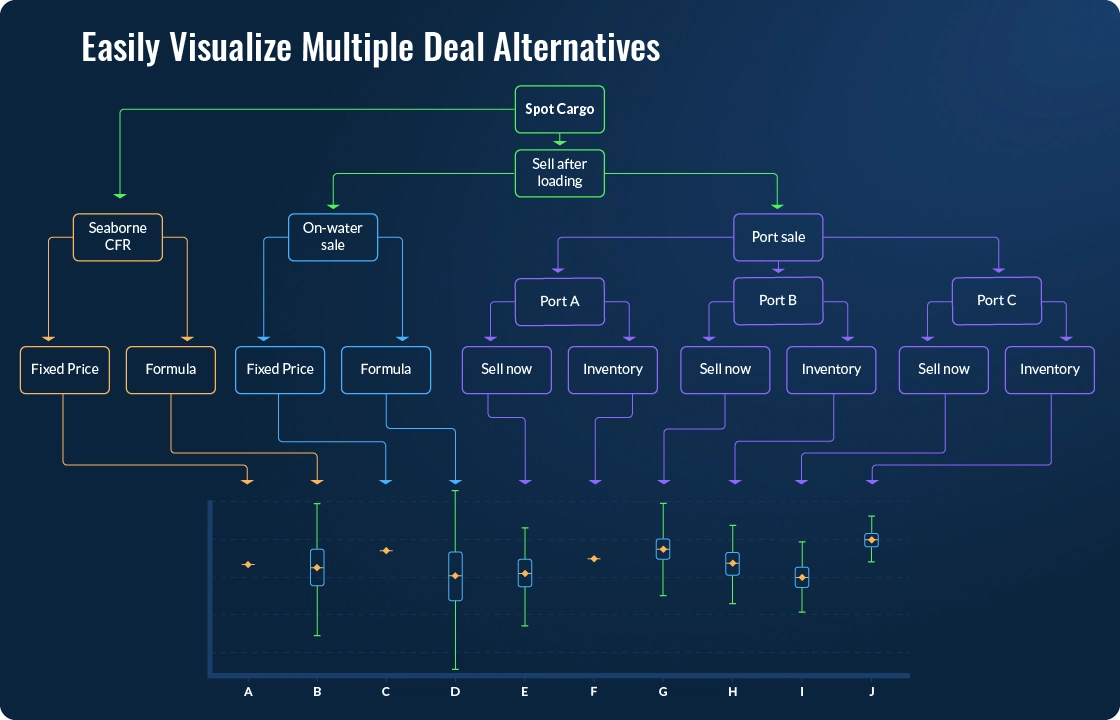

An iron ore producer had a ship full of iron ore to sell on the spot market, but they needed to determine when to sell and how to structure the sale (Fig. 1) to maximize revenue and profit margins. These decisions were complex and had significant financial implications. To make matters tougher, decision makers didn’t have the time or tools required to determine the best option.

The producer needed a solution—fast.

So their team turned to DecisionNext’s AI-driven forecasting platform. It gave them the tools to optimize decision points for spot cargo sales and streamline pricing strategies. They were also empowered to rapidly and accurately assess the risks and benefits of the various POS and structures. It also helped them maintain their competitive edge by generating an extra $200k on the spot sale of the cargo.

Figure 1 – Illustrating the complexity of spot cargo sales to identify the best point of sale and deal structure.

Simplifying Complex Decisions

As an operation grows, using good business judgment and understanding how things work within the company becomes increasingly important. Producers aim to achieve a unified market view using daily port indices and value-in-use assessments. However, without forecast data, figuring out the optimal point of sale is tough, making it difficult to select the optimal point of sale and deal structure given current market conditions to maximize profitability.

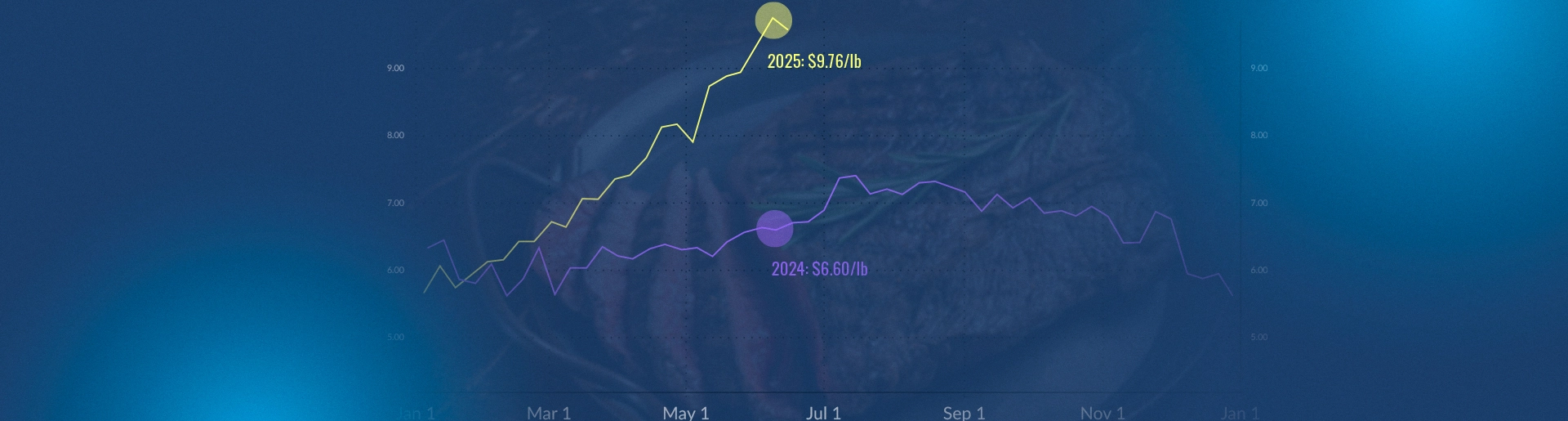

The market is fast-paced, dynamic, and always changing. With more variables, more connectivity, and more price volatility, assessing the optimal timing for transactions becomes a threat to profit margins. To select the most profitable POS between on-water and portside sales, the iron ore producer requires accurate short-term price forecasting. Producers recognize that future operating states will demand quicker and more intricate decision-making processes.

That’s why DecisionNext developed an advanced tool providing enhanced capabilities to support this dynamic environment. The system deploys top-tier forecasting to determine the optimal method for selling iron ore, assessing both potential gains and losses.

Expert and user opinion can set the parameters for different deal structures with the DecisionNext tool. It assists in simulating forecasts with risk-to-reward calculations on a single dashboard (Fig. 2).

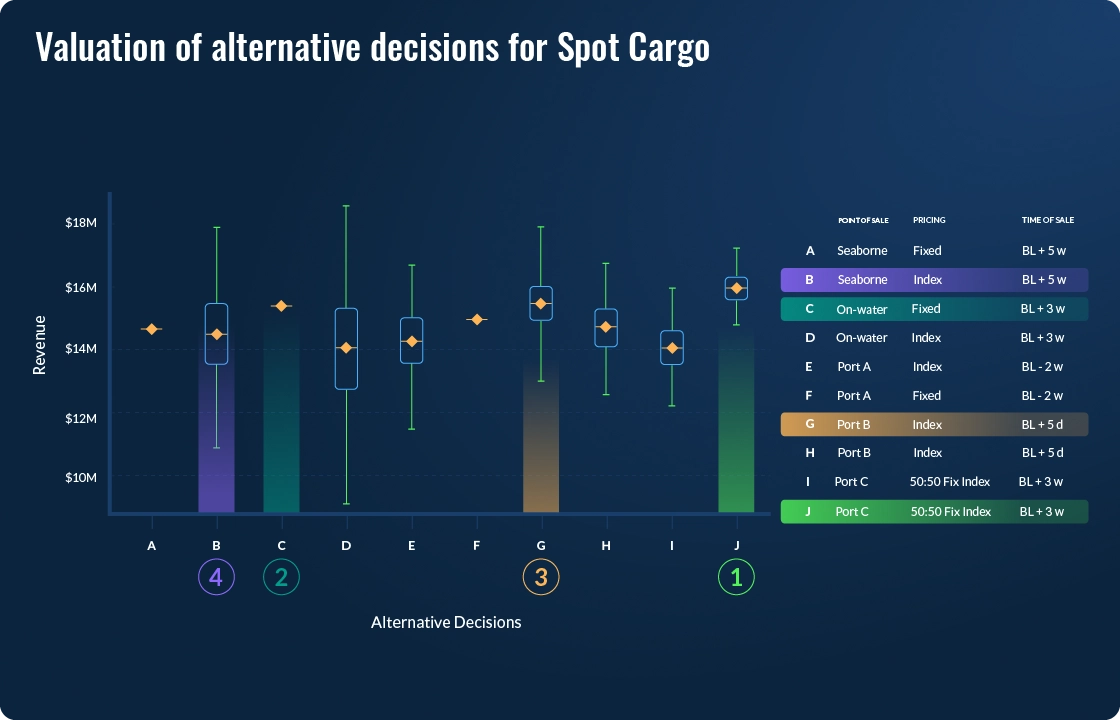

Figure 2 – Box & Whiskers Plot: Comparing 10 decision alternatives and their values with the box and whisker plots in each alternative indicating the potential upside and downside risk associated with that decision.

Accurately Weighing the Potential Upside and Downside

This analysis helps traders to select the most desirable deal structure:

- Preferred Choice: Direct the vessel to port and sell the cargo slowly in smaller parcels over a couple of weeks (Decision J). This option offers the most revenue ($16.2M) with the lowest risk.

- Second Choice: If the first option is not viable, sell on water Decision C, $15.5M the fixed price with no risk.

- Alternative Locations: If the first two options are unavailable, at Port B (Decision G $15.6M) offering the same profit with more risk or the 4th choice, Seaborne (Decision B, $14.5M).

With the DecisionNext platform, you can easily compare each point of sale to see which one will yield a higher margin while considering the risk.

In summary

Thanks to the DecisionNext platform, this iron ore producer boosted a 4.5% in revenue on a single transaction, securing an additional annual revenue representing an additional 3-5% increase in profit margins. Our solution addresses key challenges by optimizing decision-making structures and reducing the time required for critical decisions. It also offered a robust risk-to-reward assessment with a singular view.

DecisionNext provides the tools needed to navigate the complexities of the market effectively. Whether determining the best time to sell cargo on the water, directing vessels to alternative locations, or selling in smaller parcels, these tools help you maximize margins while minimizing risk. So you can make better business decisions—every time.

Helpful Definitions: Box & Whiskers Plot: Quantifies the expected value and risk of a given alternative based on hundreds of thousands of simulations for the forecasted commodities. The red line represents the mean expected value, the box represents where 50% of the simulations fell, the whiskers represent 90% of the simulations. The wider the whiskers, the more uncertainty or risk there is a decision.

Want to share this Case Study?

Copy and paste the URL to send to your colleagues. Or tap the share button up top to post to your LinkedIn page.