Rise of the Unicorns - Rethinking Corporate Innovation

Published: May 29, 2018

The first Internet wave (1995 – 2005)

For more than 250 years economic growth and improvements in our standard of living has been driven by the cycle of trade, specialisation and innovation. This growth engine took a massive step forward at the turn of the millennia with the commercialisation of the internet. From 1995 to 2005, internet users grew from just 16 million to over a one billion (10 years of 150% CAGR). Through the same period, the global trade indicator of stock of foreign direct investment measured as a percentage of global GDP grew from 10% in 1995 (having averaged 8.3% for previous 90 years) to 24% in 2005.

Throughout this internet wave, we saw the emergence of tech behemoths such as Amazon (founded in 1994), Google (1998), Tencent (1998), Alibaba (1999) and Facebook (2004). As of April 2018, these five companies had a collective market capitalisation of US $2.9 Trillion and occupied 5 of the top 10 list of the largest global stocks by market capitalisation. This does not take account of Microsoft and Apple, also “top ten stocks” worth US $1.6 Trillion together, whose reach and fortunes have been dramatically enhanced by the internet.

A next Unicorn wave (post GFC)

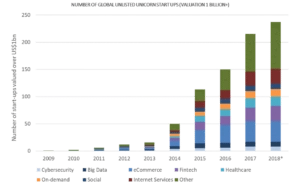

A new wave of business creation has emerged in the last 5 years, nearly a decade and a half after the emergence of the first big internet based companies. Over this relatively short period we have seen a rapid increase in the number of unlisted start-ups valued over 1 billion dollars which are less than ten years old, or “Unicorns” as they are frequently referred to (see below). This phenomenon is causing well-established incumbent businesses across all industries to question how they think about innovation and the forced transformation of their businesses.

Note: This graph omits companies that have since been acquired or listed publicly

Source: VCI analysis; CB Insights

So why has this second wave of business creation occurred? A well-researched answer to this question is beyond the scope of this note, but one could use the analogy of a maturing ecosystem where many factors create the potential for new step change organisms to emerge. Some of these factors include: the ongoing growth in base computing power; advances in Artificial Intelligence (AI) research; extensive penetration of handheld internet devices the (iPhone was launched in just 2007); innovations in light weight distributed physical infrastructure; specialist services and market platforms enabling business scale without mass; open platforms for innovation and skills; venture capital quantum and innovation; and global capital mobility to name a few.

The potential impact

The key point about this next wave of start-ups is the sheer total number, size and scope mean that as a total force they cannot be anything but disruptive for major incumbents. Large asset intensive industries, with seemingly high barriers to entry may be sceptical about the immediate threat, but this would be unwise. For example, capital should not be a barrier to new entrants given the increasing size of sovereign, super and venture funds looking for long term opportunities and the accompanying innovation in the finance and investment sectors.

Knowledge is increasingly becoming less of a barrier to new entrants with the proliferation of data, coupled with increasing transparency, accessibility and the advancing AI, enabling interpretation. Established business infrastructure is similarly not the barrier it once was to scalability given the proliferation of specialised platform-based services businesses set up to support almost every aspect of a large business. In fact, established business are likely to have a disadvantage as their services infrastructure becomes relatively inefficient and they lack the ability to extricate themselves from this disadvantage.

Take power utilities as one asset intensive industry example. These are in the process of being completely disrupted by the combination of solar installations and block-chain based trading platforms. The term “death-spiral” is commonly used to describe incumbent power distribution companies. One can also ask what the future holds for water utilities with the integration of water and energy cycles, combined with advanced in lower scale distributed water treatment, advanced analytics and block-chain trading systems.

Working across the value chain for Mining and Resource companies, one can see multiple entry points for rapid scaling start-ups. For example, exploration is basically a data and data interpretation game, with many data sources relatively open and AI advancing rapidly. The EPCM and Operating companies that build and operate mines are engaged in the race to develop full “digital twins” for design and operation, and digital platforms for project delivery and contractor management, both services which could in theory be fulfilled by rapid scale start-ups. The companies that assemble and extract value across the full value chain will ultimately be dependent on integrating software for end-to-end optimisation, again a function which is not asset intensive and which could be scaled relatively quickly.

Thinking about innovation differently

Ultimately the accelerating size and number of start-ups will force companies to change the way that they think about innovation. Typically, large companies are becoming good at watching trends, monitoring the emergence of start-ups (and potentially participating), capturing internal ideas, seeding research, managing an innovation pipeline and proliferating successful ideas through the business.

This is good, but is it good enough? Will the current, considered pipeline management approach be too slow and breakdown as numerous large start-ups swarm into existing asset industries in search of return, potentially fueled by new forms of capital and aggressive backers? The safe assumption is that the current approach is insufficient.

In re-thinking the corporation’s innovation approach a few factors are suggested for consideration:

- Establishment of separate “technology” businesses with the remit to radically improve the existing business, while seeking new models for survival when the current model becomes noncompetitive

- More aggressive venture investing in new businesses that can potentially become the source of these new models for the business

- Establishment of a portfolio approach to managing businesses with very different cultures and investment requirements

These changes will also demand a re-think of structures for Board Governance at a time when Boards are struggling with existing compliance demands – quite a challenge!

Graeme Stanway is a founding partner of VCI Ltd, a global strategy design company. Graeme has over 20 years experience in mining, heavy industry and technology businesses. He holds a PhD from Imperial College University of London, has been awarded the Medal of Innovation from the Institution of Civil Engineers in the UK. His strategy work has been referenced in the book “The First 11” as a benchmark case study in strategic transformation.