The DecisionNext Finished Goods Index Report | September 2025

Published: September 9, 2025

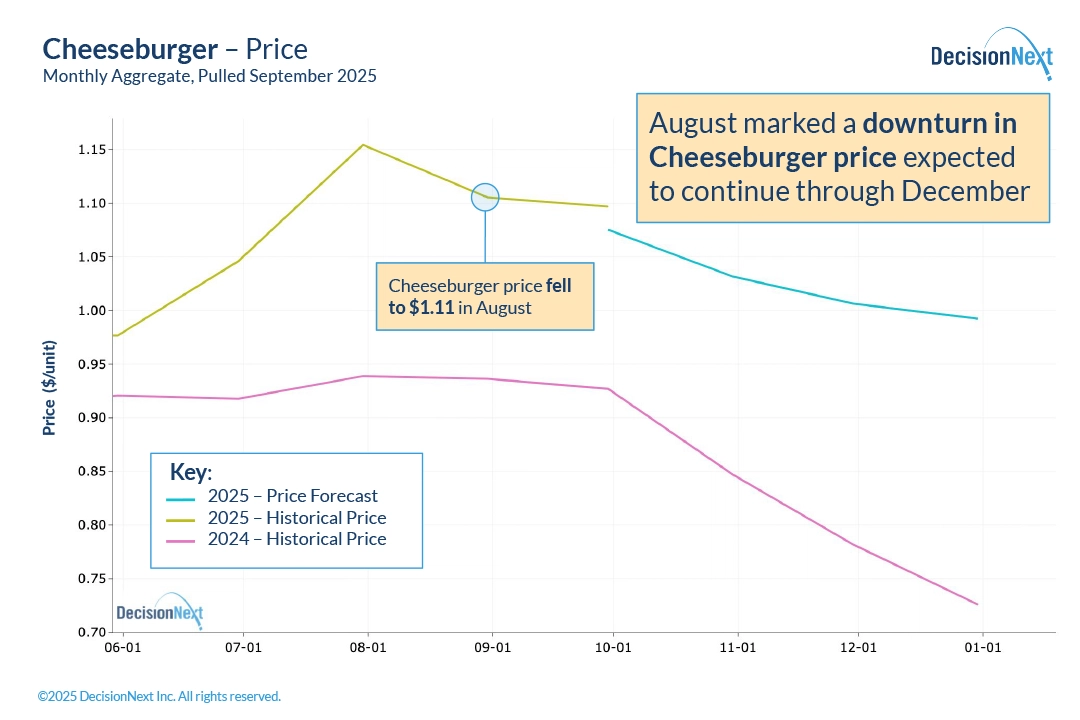

Figure 1 – The Cheeseburger Index reached 121 with a price of $1.11 in August 2025.

Figure 1 – The Cheeseburger Index reached 121 with a price of $1.11 in August 2025.

Key Insights:

- August Cheeseburger Index: 121, with a forecast of continued decline through December.

- Ground beef remains the dominant cost driver at nearly 75% of total raw material input cost.

- Declines in beef 50s—driven by seasonal patterns—are expected to ease overall cheeseburger costs into the winter.

- Cattle inventory remains tight, but short-term margin relief may be possible for processors and foodservice operators.

September Cheeseburger Snapshot

The Cheeseburger Index reached 121 in August, with the cost of the full item pegged at $1.11 (Fig. 1). This marked a retreat from the all-time highs of July, mirroring the drop in the price of 50% lean beef trim. Machine learning forecasts indicate a gentle but steady decline heading into winter, with prices expected to bottom out in December. [Click here for Finished Goods Index Methodology Page].

The key question for stakeholders: How far will prices fall—and for how long?

Protein vs. the Bun: The Cheeseburger’s Heavyweight Contender

While the cheeseburger is made up of inputs from across commodity sectors (Fig. 2), ground beef and the underlying beef trim accounts for the majority of the cost and shows the biggest month-to-month swings.

Figure 2 – The cheeseburger recipe featuring ingredients and weights for the raw materials components.

Figure 2 – The cheeseburger recipe featuring ingredients and weights for the raw materials components.

Ground beef represented roughly 75% of the total raw material cost of a cheeseburger last month. To get specific, in August the total raw inputs amounted to $1.11, with $0.83 of that tied directly to beef. Compare that to only $0.06 linked to the bun or $0.11 linked to cheese.

That means even a sharp 50% increase in bun prices would only have a $0.03 impact on the final price of the cheeseburger. In contrast, a 4% increase in ground beef price would have an equivalent $0.03 impact on the final price of a cheeseburger, indicating that even modest moves in beef trim have an outsized impact on the finished good pricing and Index value. This is critical for supply chain strategists, since beef continues to be shaped by fundamental market dynamics, not just seasonal demand.

A Window of Pricing Relief: Why the Cheeseburger Cost Is Forecast to Drop

While cheeseburger prices reached an all-time high of $1.15 in July, August marked a turning point and the start of a pricing downturn. According to DecisionNext machine learning models, this dip is forecast to continue steadily through December (Fig. 3).

Figure 3 – Cheeseburger prices peaked in July and are expected to fall through December.

Figure 3 – Cheeseburger prices peaked in July and are expected to fall through December.

Forecasted declines in the Cheeseburger Index are closely tied to movement in beef trimmings—especially 50s which are expected to fall sharply from the all time highs of July 2025 (Fig. 4).

Figure 4 – The price of 50% lean trim, the main price driver for Cheeseburger, spiked in July and is forecast to fall through the winter.

Figure 4 – The price of 50% lean trim, the main price driver for Cheeseburger, spiked in July and is forecast to fall through the winter.

Since peaking mid-year, the beef 50s market is now softening, with recent prices slipping from ~$2.50/lb to ~$1.80/lb in August.

Several factors are driving this trend:

- Seasonal slowdown in grilling demand post-summer.

- Slight easing of wholesale and retail prices despite historically tight supply chains.

- Inventory rebuild delays continue to affect long-term outlook, but the near-term dip provides breathing room.

Still, beef markets are proving to be very volatile, driven by both long-term trends and seasonal patterns. Tight cattle supply from drought-related herd reductions continues to limit availability. And high input costs, worker shortages in processing, and global trade problems also put pressure on the market. Despite all this unpredictability, beef demand remains strong.

These dynamics have affected market expectations and amplified pricing swings, even as short-term forecasts suggest some relief into Q4.

What Does This Mean for Stakeholders?

- Processors should capitalize on near-term softness in trim pricing, particularly in 50s, while preparing for renewed volatility in 2025.

- Retailers and foodservice operators may consider modest promotions or menu strategies to take advantage of slight cost reductions heading into fall.

- Strategists should note that the beef market is offering temporary relief—not a structural reset. Long-term cost baselines are still climbing.

Preparing for Ups and Downs

As the Cheeseburger Index cools into winter, protein costs still play a dominant role in price changes. Beef trimmings are showing some seasonal softening, but stakeholders should view this as a window of opportunity rather than a long-lasting trend. Planning for volatility remains essential, especially as the holidays approach and we look toward next year.

Want to see the data behind this forecast or run your own analysis? Connect with DecisionNext or access the platform today.

About the Report

The DecisionNext Finished Goods Index showcases the value of multi-commodity finished goods cost forecasting across protein, dairy, grain, and ingredient markets (see full methodology page). By comparing the current value to the average value from 2024, it helps stakeholders visualize real-time and future cost pressures and profit opportunities across value-added food products. The tool makes it possible for users to forecast finished good costs, adjust recipes, and analyze forward-looking scenarios.