The DecisionNext Finished Goods Indices – April 2024

Published: April 1, 2024

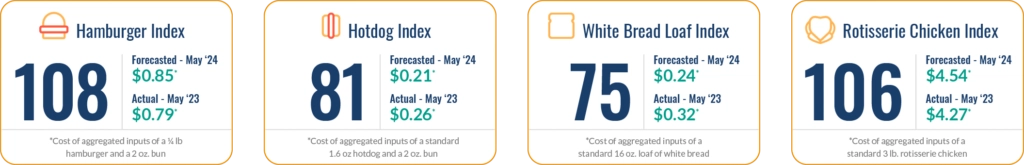

Finished Goods Forecast Indices: May 2024 (Fig. 1)  Figure 1 – DecisionNext finished goods indices for May 2024 (forecast locked on 3/28/24). To see last month’s index, click here.

Figure 1 – DecisionNext finished goods indices for May 2024 (forecast locked on 3/28/24). To see last month’s index, click here.

April 2024 Index Report

The latest values show strong signs that summer Hot Dog sales will be HOT, and sales for Hamburgers might cool down.

April Deep Dive

Our monthly index follows the 81% Lean Ground Beef market as an input into our finished good hamburger and bun forecast. Now that most of the cow culling is behind us, and the herd begins its rebuild phase, we’re likely to continue to see tight cow harvests. This will impact the lean trim supply needed to make 81 Lean Ground Beef for hamburgers this grilling season.

We’re watching two factors which may help mitigate the impact. First being the increasing import numbers from Australia and South America. The second factor is the packers’ ability to reach for different lean muscles from feeder cattle, like knuckles, flats, and eyes. Regardless of these efforts, you can expect to see higher hamburger prices hit the shelves (especially compared to last summer).

Figure 2 - Ground Beef 81 Forecast and History

Figure 2 - Ground Beef 81 Forecast and History

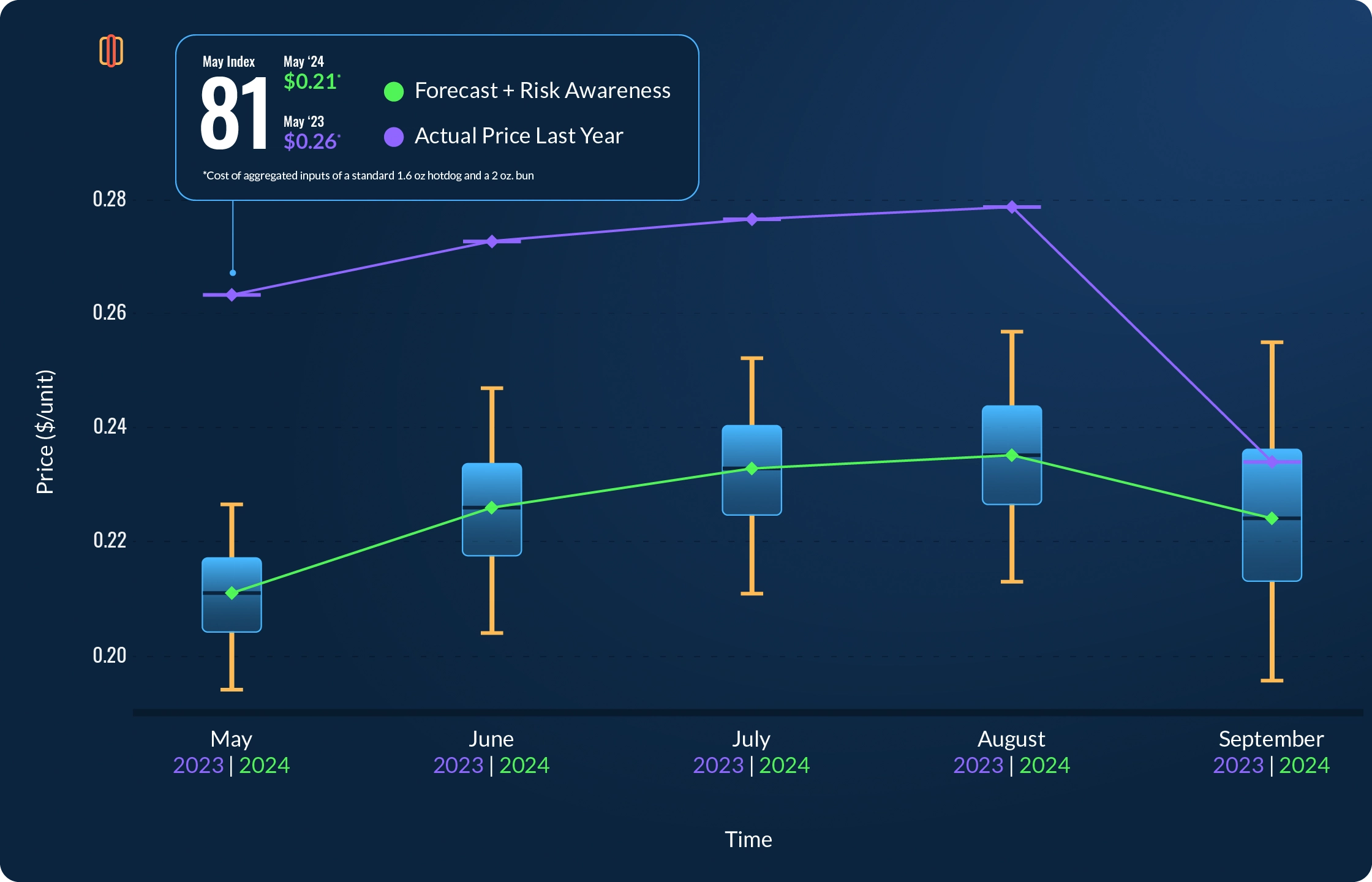

On the other hand, the beef fat trim is faring well this year. Beef 50s prices have dropped below last year’s levels and they’re expected to hold throughout the summer. And with 72 Pork Lean Trim moderating compared to a year ago, the summer is setting up to be a winner for hot dogs with prices dropping below last year. This will make hot dogs a compelling value play at the shelf.

Figure 3 - 72 Lean Pork Trim Forecast & History

Figure 3 - 72 Lean Pork Trim Forecast & History

Figure 4 - 50 Lean Beef Trimmings Forecast & History

Figure 4 - 50 Lean Beef Trimmings Forecast & History

Figure 5 - 8 ct./1 lb. All Meat Hot Dog and Bun 5 month finished goods chart

Figure 5 - 8 ct./1 lb. All Meat Hot Dog and Bun 5 month finished goods chart

Using AI-assisted models, the DecisionNext team has developed a risk-aware forecast. In Figure 2, the box-and-whisker charts illustrate uncertainty around a median price forecast. We can then observe where 50% of forecast simulations fell (within the box) and where 90% of the simulations fell (within the whiskers). The greater the spread from the top of the box-and-whiskers to the bottom, the higher the uncertainty. The great thing about this quick visual is that it shows how our models identify key goods prices moving in the future. They also give valuable insight. You can see comparisons to last year and how it could impact your promotional strategies over the coming months.

Contact us if you want to see the six-month input cost forecast comparison for any of the other finished goods included in this report.

About the Report

Overall, the DecisionNext Finished Goods Index Report showcases the flexibility of our tool’s range of solutions. It offers multi-commodity forecasting for all major proteins and grains consolidated into a single finished goods forecast for illustration. The report also shows the ability to choose the timeframe for the forecast and the option to customize recipe templates to optimize finished goods profitability.

*How the Indices are Calculated: The index for each finished good is calculated by taking the forecasted aggregate price for the inputs for the month in question and dividing it by the historical aggregate price for those same inputs over the same time period last year. Essentially, we are using the tool to forecast the finished goods cost for the month, and then making the YoY comparison to the actual cost from the previous year for that same time period.

Sign up for our FREE newsletter, The Formula.

Every month you’ll get a Finished Good Report along with a deep dive, so you can start to track important trends over time.