The Beauty of Backtesting in Forecasting

Published: April 30, 2020

In fact, every forecast will be wrong. The variable is determining how wrong it will be.

When a forecasting model lacks validity, it leads to detrimental business decisions, causing more harm than good.

That is where backtesting makes a difference

With backtesting leading the way to stronger, more accurate forecasts, business leaders can be sure they will be more confident in their decision-making.

What is backtesting?

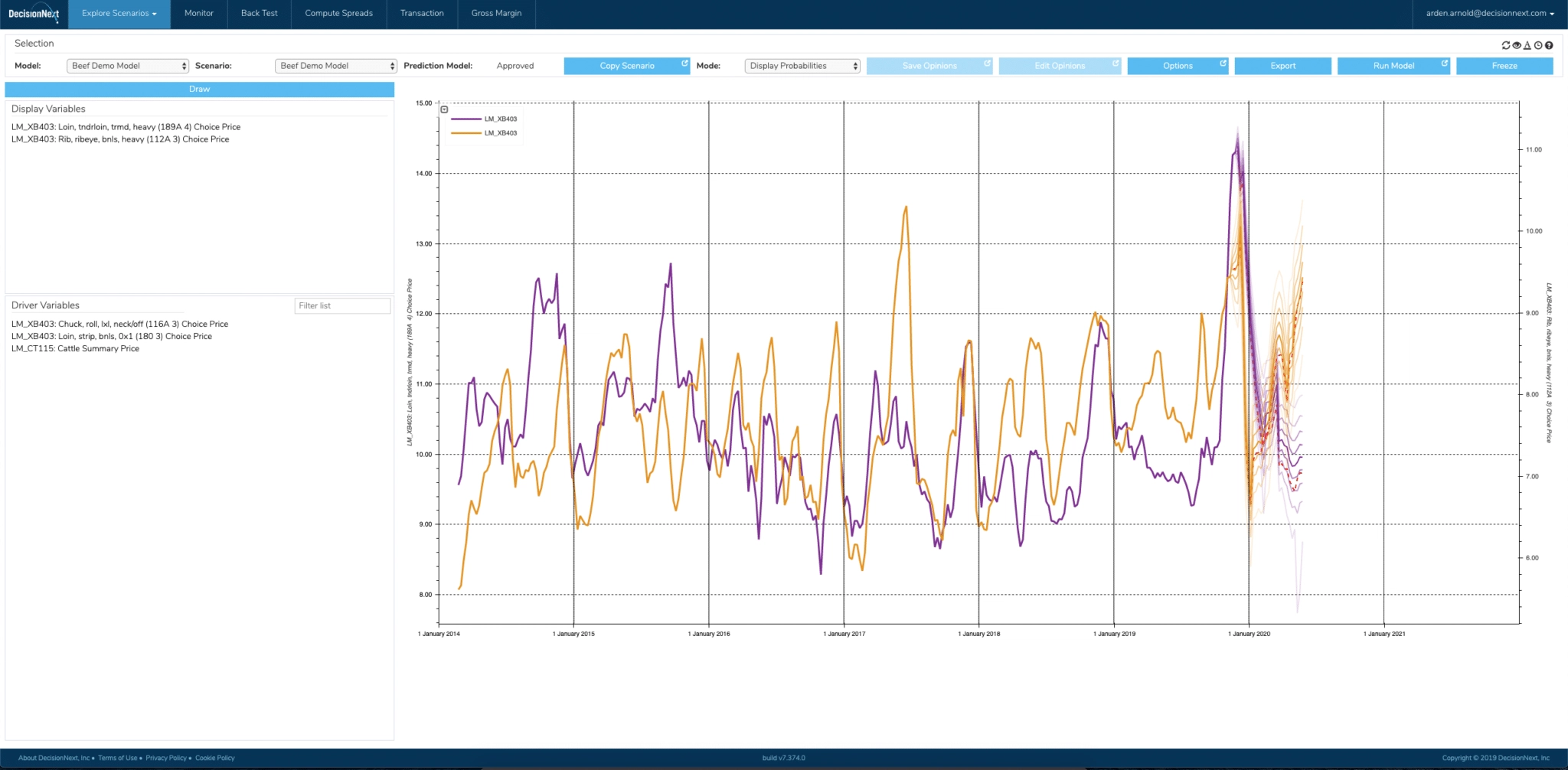

Backtesting is a simulation method that involves taking a current idea or strategy and applying it to data from a past situation or period of time. Essentially, businesses can use backtesting to determine whether or not certain financial decisions or business strategies should be used moving onward by testing them on risk-free situations that have already happened.

This tool is especially helpful for testing the validity of forecasting models. Businesses that want to see if a specific forecasting model will lead to desirable results in the future can test that model using historical data.

If the model provides inaccurate results, no harm has been done, and businesses know they should try something different. If the model produces accurate results when used on data from the past, it is likely that it is a valid model that will be able to produce accurate results when used on current and future data.

How backtesting helps businesses

Backtesting allows businesses to trust that the forecasting model they want to implement is the best possible option before they use it to make decisions that can have upside potential or costly consequences.

Backtesting is a useful tool that many businesses use regularly. Uber, for example, uses its data analytics and machine learning platforms to help them with budget management, ride organization, and pricing decisions.

Because different factors like location and customer demographics can influence whether or not a particular forecasting model is effective, Uber implemented large-scale backtesting that allows them to test the validity of hundreds of forecasting models with these key factors in mind. Now, they are able to quickly see which forecasting models will be best to implement in order to make healthy financial decisions.

Backtesting in commodity industries

Commodity industries realize volatility at an increasing pace these days.

Markets shift prices. Weather changes outlooks. Trade and politics breed uncertainty. The list goes on.

But backtesting can be the secret weapon to help teams better understand their markets. By running a multitude of scenarios and applying backtesting functionality, leaders and analysts can begin to lower the risk threshold.

It’s a powerful dynamic that relies on ‘human and machine’ working in tandem. With backtesting in your back pocket, companies across the commodity spectrum can expect to move faster, with greater confidence, and drive better business decisions.