Markets are too volatile for procurement and sales decisions to be made without a consistent, data-driven process. Otherwise, emotional reactions can be our greatest enemy, and we do not even know it. At DecisionNext, we say, “If you do not measure, you can not improve.” If we are going to use data instead of emotions, we need to understand how to sort through the mountain of data to focus on the key pieces of high-value information. This process should begin with an accurate and transparent forecast, even better if you have multiple outlooks.

This is because a forecast, whether it is our cutting-edge AI/Machine Learning forecast or the market-beating beef cutout forecast, distills a lot of market information across many sources into a consistent, reliable, and accurate outlook of where the market is going. These mathematical models distill information in a way that an individual with their own biases and assumptions can not. But forecasts are not the only part of a data-driven process; the next step is to layer in additional data and industry context to gain deeper insight into the market’s current state and future outlook.

To showcase the importance of integrating data beyond just price forecasts to understand market outlook, we highlight the unprecedented price spikes in the choice chuck roll in September and October 2024. These examples show how layering data beyond just a forecast can improve decision-making in a volatile market.

1. Leverage Forecasts to Deepen Your Market View

The first step in building any buying/selling plan is to anchor the decision in the current price environment. Next, layer in consistent, reliable price forecasts to distill the market’s complexity into a clear outcome. With DecisionNext, beef buyers have four forecast models (Cutout, Machine Learning, CME, and Fundamentals), each capturing different factors that drive and predict the market. The goal is to forecast the expected price as well as the trend to understand the broader context and risk around where prices are going. When multiple forecasts are aligned, confidence increases; when they diverge, the market signals greater uncertainty and warrants closer inspection.

One of the first steps in evaluating the forecast outlook is to track forecast performance, available with all forecasts provided by DecisionNext. This performance, whether that is how far the final price is from the forecasted price (Forecast MAPE) or the directional accuracy (Direction Predictive) of the forecast, tells us which factors are driving the market and which forecast is most likely to reflect future market conditions going forward. Users have access to all this information, and a newly released product feature makes it even easier to see, as it is presented in the Direct forecast graphs and the table.

2. Deciphering the Industry’s Sold Position to Unpack Market Risks

While a forecast aims to simplify market complexity into a dependable indicator of future trends, there is often extra information that can enhance our understanding of market conditions beyond just the forecast. One such data is to understand the “industry’s sold position” through the USDA’s comprehensive beef report. Combined with a forecast, this data broadens our understanding of how cattle supply aligns with sales and pricing.

To understand the supply side of beef, it’s helpful to consider that, in the near term, supply is mostly fixed and constantly coming—think of Lucille Ball at the chocolate factory. The meat moves through the supply chain and needs to be sold. To avoid backups and balance the market, market participants generally use two main types of beef contracts: negotiated and formula. Negotiated contracts are agreements between buyer and seller for a specified price and volume on a set date. Formula contracts are supply agreements in which the volume is fixed (e.g., 40,000lbs delivered each week for three months), but the price is determined later, typically based on a formula linked to the market’s average negotiated value from the previous week. These formula contracts allow long-term supply agreements that can accommodate market price volatility. The alternative to formula contracts is fixed-price contracts, which require frequent renegotiations or generate significant market-price risk over time, exposing either the supplier or the buyer to price movements. Most beef sold in the industry is on formula contracts (56% of total loads through the first eleven months of 2025), which form the backbone of the industry’s sold position because it represents the most consistent share of the industry’s beef volume.

With supply largely constrained in the short term, if beef volume is not already committed under formula contracts, it must be sold under negotiated contracts. Accordingly, the volume of negotiated contracts largely reflects the industry’s supply-and-demand balance and, thus, price. Consider, in general, that a decrease in formula volume with a constrained supply means more negotiated volume must be sold. This increase in volume in the negotiated market could go to a buyer who moved from formula to negotiated, leaving the same number of buyers in the market. Most likely, the formula buyer may not be in the market, in which case the sellers must sell more volume to the same number of negotiated buyers.

To meet the needs of both buyers and sellers of volume not on formula contracts, negotiated contracts can vary by delivery dates. These horizon lengths, from sale to delivery, can range from near term (within the current week) to several weeks ahead (e.g., six weeks). The USDA classifies negotiated contracts as ‘negotiated’ if the delivery occurs within 21 days of the sale, and “forward negotiated’ (or simply “forward’) if delivery is scheduled for delivery in the next 22 to 90 days. Beyond 90 days is too thinly traded to be reported by the USDA and ends up in the comprehensive report. By tracking negotiated, forward, and formula volumes—thanks to USDA—an overall picture of the industry’s sold position can be inferred.

For example, in the Choice Chuck Roll market, roughly 55% of weekly production is typically sold on formula, leaving the remaining 45% to be placed into negotiated contracts. If forward contracts suddenly increase by 5%, it takes that much out of future volume in the negotiated market. If the number of negotiated buyers is unchanged by the forward buy, the same number of buyers are now competing for less product, tightening the market and placing upward pressure on price. To make this concrete, Table 1 summarizes the sold-position data for the week of Dec 8, 2025.

Table 1. Industry Sold Position Summary (Dec 8, 2025)

| Metric | Value |

|---|---|

| Total Comprehensive Volume (loads) | 259 |

| Formula share of total | 52% |

| Forward share of total | 5% |

| Formula + Forward share of total | 57% |

These metrics must be read together because each reflects a different component of the industry’s sold position. A sudden increase in formula share, for example, may simply reflect a shrinking total supply rather than a true shift in buyer commitment. Hence, total volume is also important to track. A change in forward volume due to a change in behavior, and thus quickly distilled through a forecast, will affect all of the above variables and serve as an indicator of future availability. Combining this with the formula share of total, we can assess how tight the market is likely to be, given the change in forward positioning. All of these variables help to unpack the industry’s sold position.

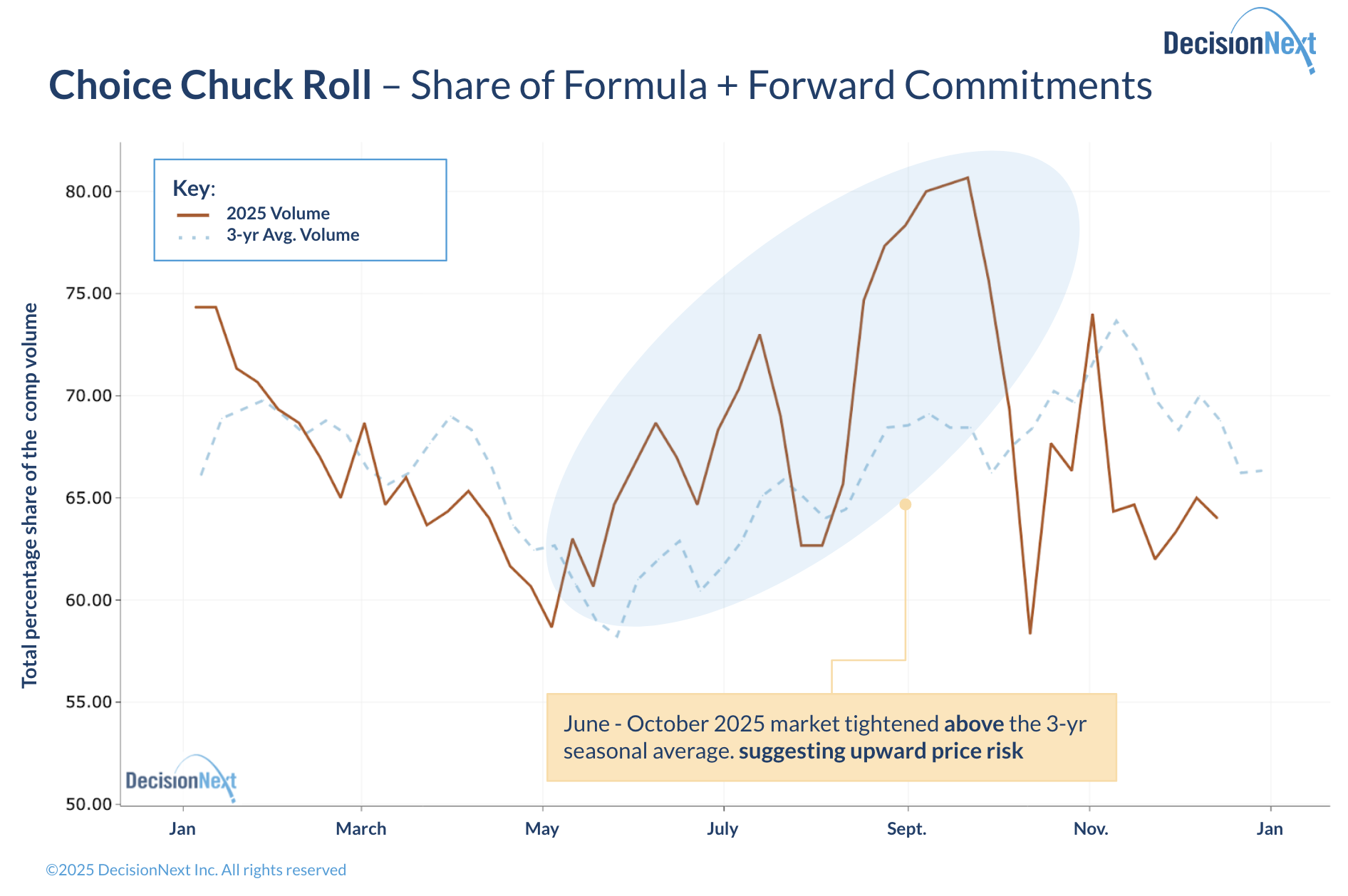

Figure 1. Share of Formula + Forward Commitments for the Chuck Roll (as % of Comprehensive), compared with the 3-year average.

Looking at our example of choice chuck rolls in September and October 2025, the first step is to understand how sold the industry was heading into the usual fall peak (see Figure 1). We can see from the graph, from May to October, how much sold the industry was compared to usual patterns. There was a dip in August, but from May to September, the trend suggested a largely tightening market.

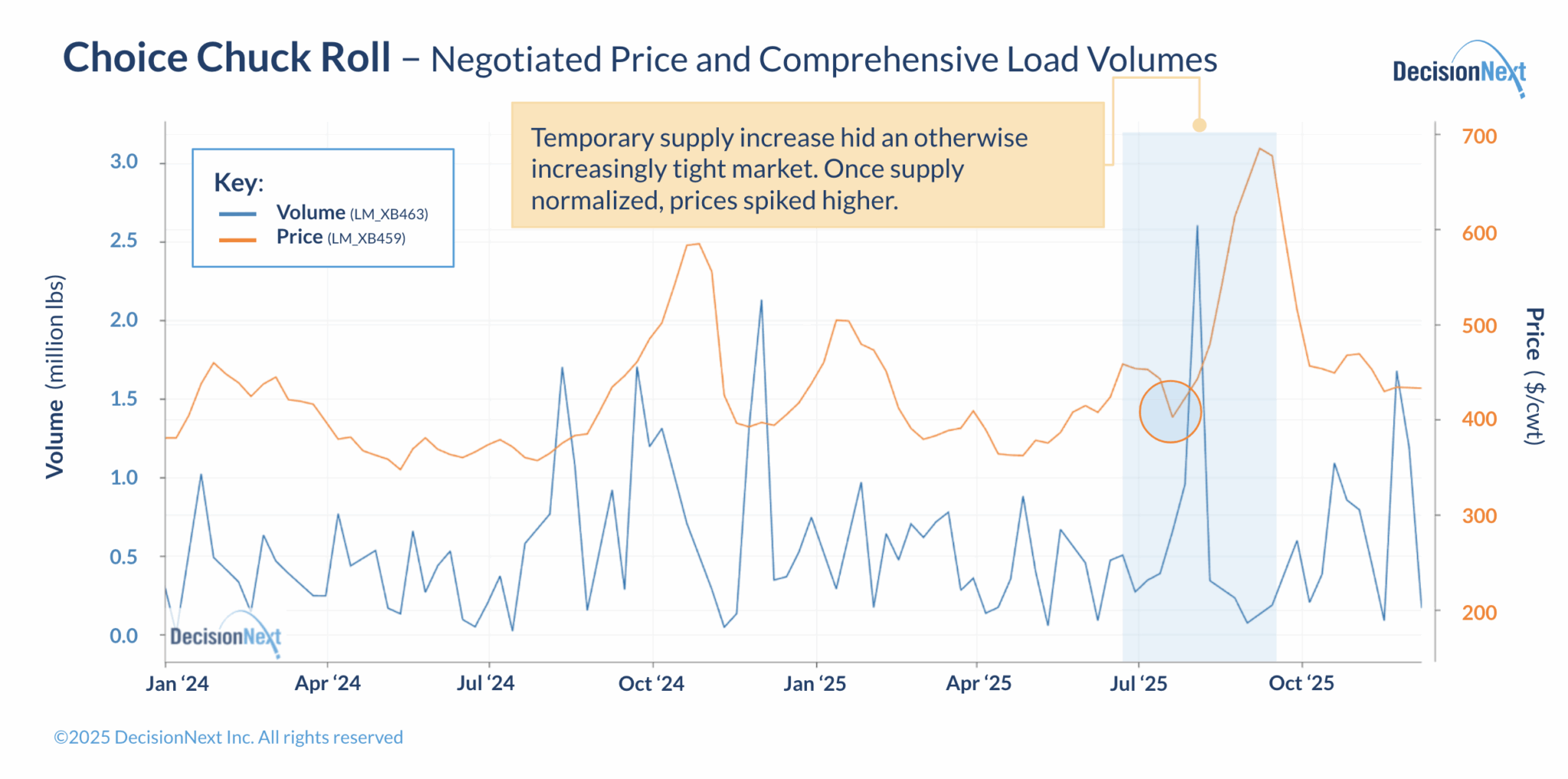

Figure 2. Choice chuck roll negotiated price and comprehensive load volumes

Examining total comprehensive volumes, we see a large supply increase and decline by the end of July 2025. This supply increase caused prices to dip despite the upward trend of a tighter sold position (see Figure 2). When supply returned to normal levels, the price spiked upward due to the “hidden,” increasingly tight market (see Figure 1).

In short, the industry’s sold position provides the behavioral overlay (as well as if you add in your own) to your forecast view: it helps you judge whether the direction shown by the forecasts is likely to play out smoothly or be disrupted by tightening or loosening supply conditions. Additionally, how your own business decisions (and those with similar buying patterns) may also impact the market. This data reinforces or challenges the forecasts, providing a clearer picture for confident buying decisions. To take this even further, we can use tools to examine how changes in these numbers, based on your assessment of where the market is heading in terms of buying behavior, will provide additional insight.

Takeaways

DecisionNext forecasts provide a consistent, high-quality outlook for where the market is heading, while the industry’s sold position reveals how buyers and sellers are behaving behind the scenes. When used together, these tools help buyers anticipate turning points earlier, time their purchases more effectively, and avoid being caught off-guard by sudden price movements, just as the chuck roll example demonstrates. Buyers who follow this structured two-step approach gain a measurable advantage in planning and negotiation.