Global Appetite, Domestic Impact: How Short Ribs (123 A) Prices React to Trade Disruptions

Published: May 21, 2025

Key Insights

- Asian export markets are a primary destination for short ribs (123 A); disruptions on export volume ripple through domestic pricing.

- Assuming the domestic market could have to absorb 4 loads of short ribs per week between June 1 and August 5, prices for this item could drop between $0.25 and $0.50 (see forecast).

- DecisionNext’s platform enables stakeholders to input expert assumptions, assess risk, and visualize forecasts with and without the assumption factored in.

When there are shocks to the supply chain and global trade shifts, domestic markets often feel the aftershocks—especially in the beef complex. Short ribs (123 A), a cut with strong export demand in Asian markets, can provide a textbook example of how international dynamics have the ability to influence domestic pricing.

With current turbulence in U.S. tariff policy and uncertainty about future access to key Asian buyers, U.S. packers and buyers alike face a critical question: what happens if export volumes decline and domestic markets must absorb that supply?

A Trade-Sensitive Cut

Highly popular in Korean and Japanese cuisine, short ribs (123 A) are often thin-sliced for beef bowls or BBQ dishes. Their high fat content suits these markets but limits appeal in the U.S., where such cuts see little mainstream demand.

In the case that exports soften, few domestic channels exist to absorb the volume. Some may be redirected to grind programs or niche foodservice applications, but these outlets can’t match export values or scale, leading to excess supply and softer prices.

Modeling the Market Impact with DecisionNext

Consider a market shock that reduces export demand—suddenly, the volume once bound for international buyers must be absorbed by domestic markets. The DecisionNext forecasting platform empowers users to build out scenarios like this in order to test the impact on price. In other words, the DecisionNext platform allows users to layer assumptions over historical and forecast data, showing how the price forecast for the item could change given the assumption in question.

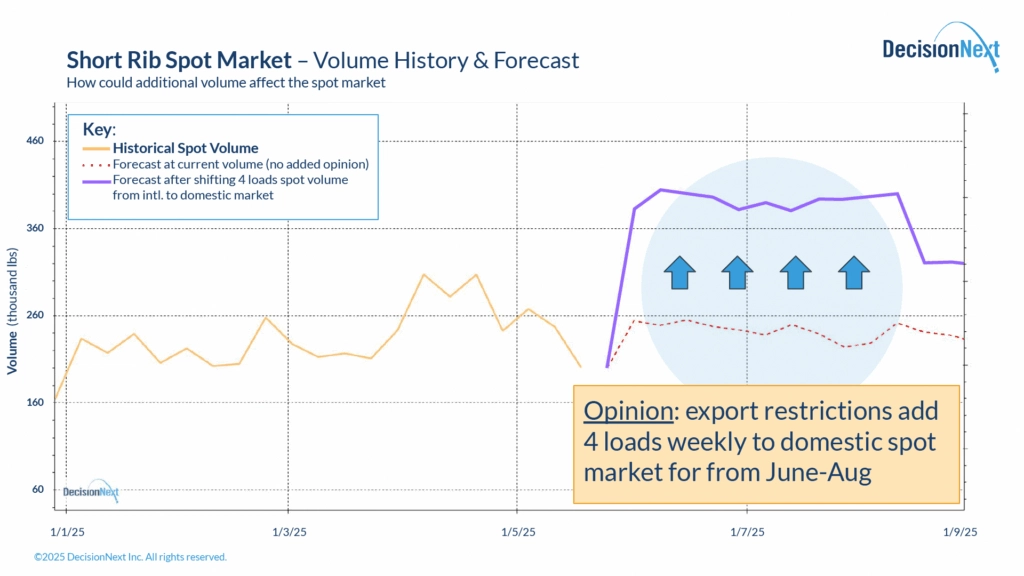

In this case, we test our ‘opinion’ that US tariffs and other macroeconomic factors will cause export volumes to decline over the coming months, forcing domestic markets to absorb the volume this summer. To quantify this shift, our experts enter the opinion that four loads a week (about 160,000 lbs) of short ribs will be absorbed by the domestic spot market between the first week of June through the first week of August (Fig. 1).

Figure 1 – The impact on domestic spot volumes if export restrictions add 4 loads of short ribs to the domestic market weekly from June - August.

Figure 1 – The impact on domestic spot volumes if export restrictions add 4 loads of short ribs to the domestic market weekly from June - August.

* Note that if your team thinks that tariffs could have a more dramatic effect on exports, you could just as easily test out a scenario where 6 or 8 loads of short ribs get absorbed by the domestic market weekly over the same time period.

What Happens When Export Volume is Absorbed by the Domestic Spot Market?

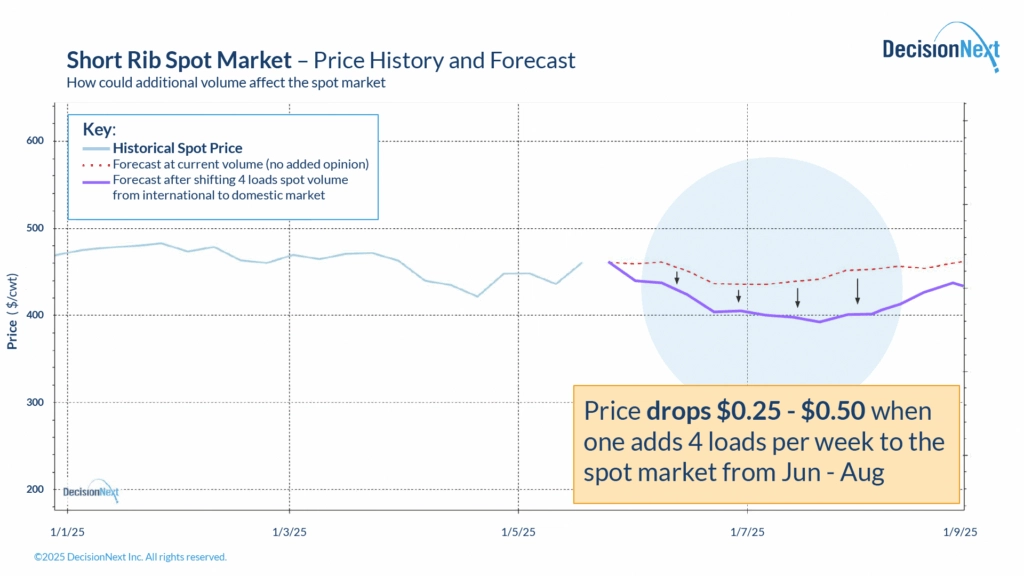

When export volumes decline, added supply weighs on domestic markets. In this example, with four additional loads per week from now until the first week in August, the forecast shows short rib (123 A) prices falling between $0.25 - $0.50 over that time period (fig. 2). That’s a dramatic price drop driven by the market absorbing product that would otherwise go overseas.

Figure 2 – Domestic spot prices of short ribs (123 A) could drop $0.25 - $0.50 this summer if export restrictions add 4 loads of short ribs to the domestic market weekly from June - August.

Figure 2 – Domestic spot prices of short ribs (123 A) could drop $0.25 - $0.50 this summer if export restrictions add 4 loads of short ribs to the domestic market weekly from June - August.

Why This Matters – And What You Can Do About It

Most forecasting tools stop at historical trends. The DecisionNext platform goes much further: modeling future outcomes and letting users simulate assumptions to see probable results. Instead of spending time discussing what happened, your team should be focused on what will happen—and plan how to react.

The takeaway? You can test this same scenario across any trade-sensitive protein cut (Chuck Flaps, Navels, etc.) and use it to inform buying, pricing, and supply strategies.

Don’t Fly Blind

Contact DecisionNext to simulate these scenarios using your assumptions and your data. See what happens when markets shift—before it hits your bottom line.